Managing Execution Risks for Facility Relocation Projects in China

Facility Relocation Projects Are Likely to Continue to Grow in China in the Near Future

On August 12, 2015, a series of explosions at the Port of Tianjin, China, rocked the bayside city, killing more than 100 people and injuring hundreds more. The calamity unfolded at an industrial site where large quantities of hazardous chemicals, including sodium cyanide and ammonium nitrate, were stored. According to media reports, an initial fire or explosion at the site led to another massive explosion and several smaller explosions, resulting in widespread devastation in a densely populated area.

The heavy casualties stemming from the disaster in Tianjin spurred growth in manufacturing and industrial site relocation projects across China1. But even before the disaster, manufacturing facility relocation projects had become prevalent as companies sought to move plants and factories away from crowded industrialized areas. Today, companies are also seeking opportunities to tap into expanding areas of domestic consumer spending.

As many as 1,000 plants are estimated to be relocated or upgraded in China2. Lost in the movement to transplant assets to new locations, however, is recognition of the risk involved in executing such projects.

IPA data on facility relocation projects performed globally show that relocation projects demonstrate poor predictability; on average, they slipped their execution schedules by 14 percent and overran their budgets by 7 percent, thereby weakening the return on investment to business. Misplaced confidence in the practicality of moving manufacturing assemblies and equipment bears much of the blame, but so too does omission of industry-recognized practices for project planning. The potential for more substantial investments in capital and lost asset value may, in fact, diminish the expected returns sought by business executives. So, it is worth taking a closer look at what is causing so many companies to consider these projects in China and how execution risks for relocation projects can be mitigated.

Regulations, Incentives, and Opportunities

A few recognized practices are contributing to the rising manufacturing facility relocation projects trend. And the trend is not expected to end any time soon, given the central Chinese government’s focus on re-balancing economic development in different regions of the country.

First, over many years, residential neighborhoods have been developed in close proximity to manufacturing facilities in China, not unlike the industrial site at Tianjin. The population growth in these local regions is often accompanied by increases in land value and, subsequently, the need to rezone industrial sites to reduce risks associated with having a large residential population nearby. Some local governments have even begun to reject renewal of land lease requests for manufacturing sites.

Second, the environmental regulation and process safety regulations driven by the Chinese State Administration of Work Safety are more stringent than in years past. The disaster in Tianjin heightened awareness and the intensity of work safety regulation enforcement, leading to the increased relocation of manufacturing facilities.

Third, incentives external to the company and known to business executives and project teams make the business case for some projects difficult to ignore. Chinese governments at local levels are incentivizing companies to move their industrial activities from developed regions to less urbanized areas in Central and West China. But government-backed incentives are not the only reason companies are willing to transplant manufacturing sites.

Companies are pursuing potential lower manufacturing costs and new business opportunities in these less-developed regions. Lower labor wages and land costs in these regions, plus proximity to new business opportunities, make facility relocation projects attractive to investors. Further, a shortage of manufacturing labor in coastal regions in China is increasingly likely as migrant workers are more inclined to stay in Central or Western China, where lower living costs compensate for the lower wages3.

In addition to economic and demographic reasons, some multinational companies that have invested heavily in China’s industrial sector for more than a decade have indicated their interest in consolidating various assets. Although the location of such consolidated efforts may not be entirely clear, the importance of executing relocation projects effectively cannot be underappreciated.

Optimism Is Risky for Manufacturing Facility Relocation Projects

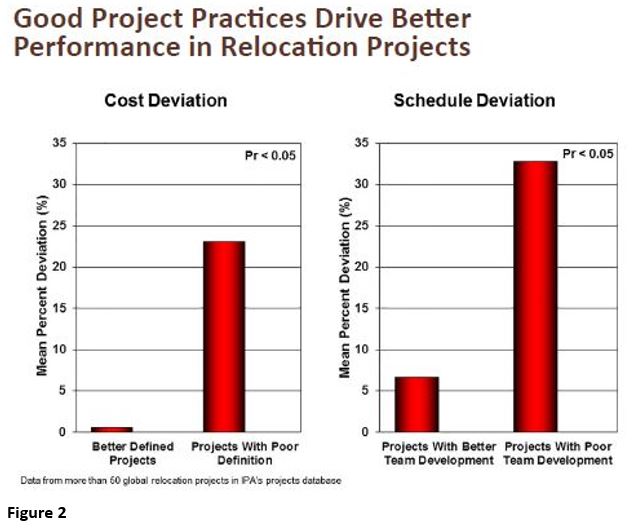

Drawing on data from more than 50 global relocation projects, IPA has observed that relocation projects come with their own risks, ones that are often overlooked during investment evaluation and front-end development. A common risk to relocation projects is the optimism on reusing equipment, which drives the unrealistic assumption: “We can save money by reusing equipment from Site X; if it works there, it should work in the new plant.”

Business executives and project managers set high expectations for reuse of relocated equipment. They assume the relocated equipment can deliver the same operational performance (i.e., no effect to the production rate and product quality) as soon as the key is turned at the new location. IPA evaluations of relocation projects, however, show that, in many instances, projects that reuse equipment could not deliver the expected operational performance without requiring additional unplanned rework before and after startup. Relocated pieces of equipment, even those running at full capacity prior to moving to the new site, almost always arrive at their new locations in worse shape than anticipated. Project teams must address these post-delivery technical challenges.

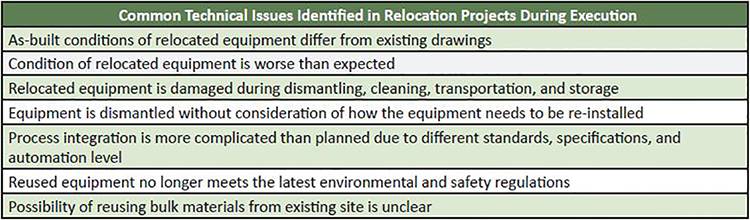

These unexpected technical challenges are often managed by implementing additional scope or design changes on the projects or performing unplanned refurbishment to reinstate the relocated equipment to its “expected” as-built condition. In some cases, new equipment must be procured to replace the unusable relocated equipment. These solutions require additional capital expenditure and time.

Other than the effect on CAPEX and project schedule, some relocation projects suffered from early operational issues. For instance, organizations may fail to fully appreciate the significant operating and maintenance knowledge lost from the existing site, so operators at the new site are not adequately trained to operate the relocated process/equipment. In addition, some relocated equipment may require more maintenance or hard-to-source parts due to age, thereby affecting operating expenditures. All these factors, including CAPEX and schedule effect, erode the business case, delivering a lower than planned return on the investment (Figure 1).

Better Project Definition Drives Better Outcomes

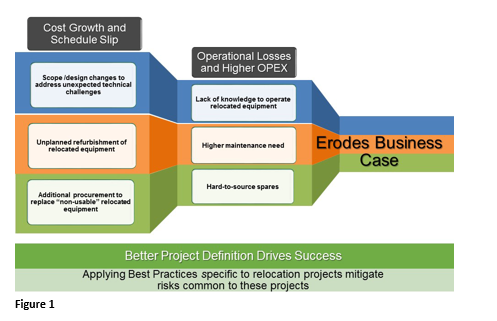

In examining the reasons behind the common issues manufacturing facility relocation projects experienced, it becomes clear that the damage to these projects is largely self-inflicted. Better project definition—which entails clear project objectives, a fully developed scope, integrated teams, and detailed designs—drives better outcomes in relocation projects, particularly when teams applied specific elements of industry Best Practices IPA identified as relevant to facility relocation projects (Figure 2).

In examining the reasons behind the common issues manufacturing facility relocation projects experienced, it becomes clear that the damage to these projects is largely self-inflicted. Better project definition—which entails clear project objectives, a fully developed scope, integrated teams, and detailed designs—drives better outcomes in relocation projects, particularly when teams applied specific elements of industry Best Practices IPA identified as relevant to facility relocation projects (Figure 2).

Of course, executing projects in China always comes with specific challenges during project delivery. The challenges listed below must be addressed during project planning to ensure these risks are adequately mitigated.

Intellectual properties (IP) protection considerations

It is essential for business to consider how the operating IP knowledge gained by the operation/maintenance team at the closing site can be protected if these teams decide not to move to the new site. Crucial technical IP information related to the process and equipment technology can also be lost during dismantling, transportation, and installation.

It is essential for the project team to align on and define the IP protection strategies with business during FEL to ensure adequate protection and additional capital expenditures are reflected in the cost estimate and project schedule.

Cost Incentives from the Chinese Government can be Confusing

Based on feedback from project teams, the fine details on the incentives to relocate can be vague. It is not uncommon to find that the details are only worked out late in execution or early operation in China. This confusion and late clarification can affect the business case, drive changes, and disrupt project execution.

Region-Specific Issues Can Impede Project Execution

With the rising trend of investments in Central and West China, business and project teams need to recognize that these regions differ culturally from the coastal regions, and working with the local governments in these regions can differ from the coastal regions. Avoiding issues takes more than just establishing good relationships. The local authorities may lack the relevant experience if the new site is located in a newly established industrial zone. Further, the government agencies work at different levels depending on the level of authority they have (i.e., whether they are county-level authority, prefecture-level, or provincial level). Longer permit application times should be expected when the local authority has to go through many layers of approval above it. Finally, local labor productivity can also differ from the coastal regions due to differences in attitudes and experience.

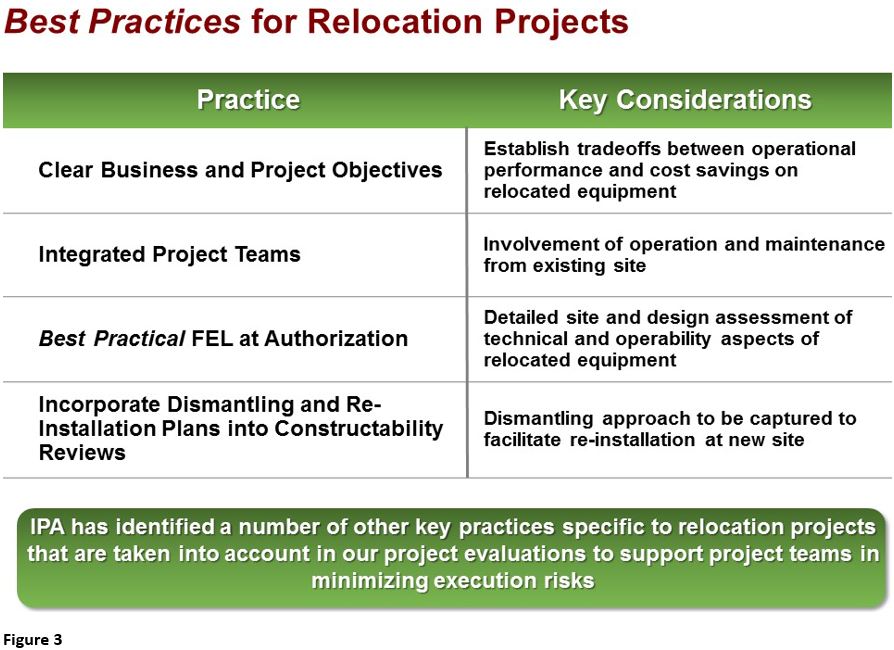

Making unrealistic assumptions is a common pitfall of relocation projects. However, executing relocation projects successfully without eroding the business case is possible with the use of industry Best Practices and realistic schedule and cost target setting (Figure 3).