Portfolio Management Instability Drives Less Predictable E&P Sustaining Capital Project Outcomes

This article is based on Upstream Industry Benchmarking Consortium (UIBC) research titled, “Effective Management of Site & Sustaining Capital Project Portfolios,” (November 2017) by IPA Associate Project Analyst Ifunanya Onwumere and IPA E&P Research Team Lead Jonathan Walker

E&P owner companies today allocate significant capital to fund short-cycle and sustaining projects, such as tie-back installations, facilities refurbishment, and debottlenecking activities. These brownfield capital projects usually entail maintaining or replacing aging assets that threaten to erode production expectations. These projects often are attractive capital investments because they promise short payout times. However, the E&P industry has not been diligent about improving the capital effectiveness of these small to midsized capital projects, and the end result is performance volatility.

A 2016 IPA analysis1 of more than 300 sustaining capital projects identified reasons why sustaining capital projects experience wide variances in cost, schedule, and functionality outcomes. In many cases, weak project organizations, inadequate staffing, and streamlined work processes were found to have contributed to portfolio management inefficiencies. IPA recently took a closer look at these issues. In surveying more than 50 E&P portfolio management leaders from 16 owner companies, IPA found that portfolio instability and disruptions are underlying factors contributing to the industry’s troubles in delivering predictable and consistent sustainment project outcomes. Asset and business unit leaders mutually agreed that sustaining capital project portfolios are subject to frequent changes in business priorities. Compared to major project portfolios—traditionally developed with a long-term perspective—sustaining capital projects are contingent on production and uptime requirements and operational needs. Portfolio managers for sustaining capital projects are, therefore, tied up in a constant balancing act, balancing operational needs and the need to execute projects simultaneously.

Today’s Reactive Portfolio Management

It almost goes without saying that portfolio management is a well-known subject. Nevertheless, applying Best Practices for managing sustaining capital project portfolios often poses challenges for business leaders. Resources are limited and projects have multiple potential sources of risks, failures, and opportunities, particularly as an asset ages. Typically, projects do not have the funds, capacity, or time/manpower to pursue all ideas. This reality makes it difficult to implement defined portfolio management practices in a consistent and structured manner. Unfortunately, Industry has taken a reactive approach to sustaining capital project portfolio management. Inconsistent outcomes are not wholly surprising.

In conducting its latest research, IPA matched its portfolio manager survey responses with actual project performance data from more than 200 projects in IPA’s databases in its latest work on the subject. In doing so, IPA found inconsistencies in portfolio management practices across seemingly similar business units in Industry—and even across business units within the same company.

IPA looked at two categories of portfolio metrics—Delivery metrics, including cost and schedule data, and Stability metrics, such as recycle and rejection rates, frequency of break-in/unplanned projects, etc. These two categories of metrics were linked to known portfolio management Best Practices. As a result, IPA successfully developed a portfolio management framework for E&P sustaining capital projects that is based on six elements that are statically correlated with better project outcomes. A portfolio management approach falling within the framework can aid in ensuring continuous alignment between business plans and asset sustainment priorities. One element of the framework, for instance, involves opportunity initiation practices.

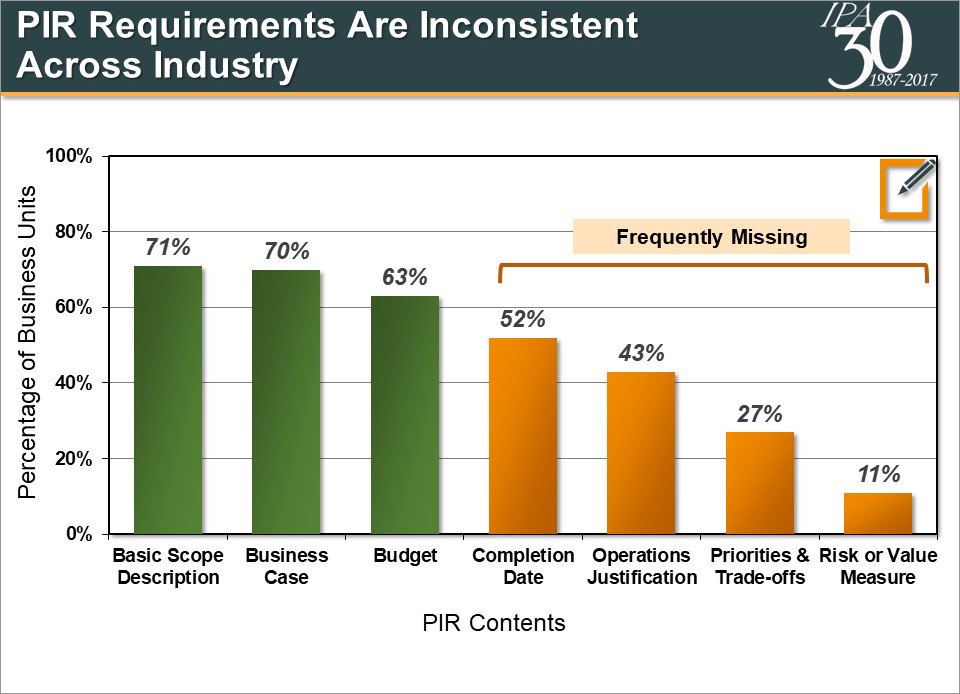

Most companies have an initiation request process, often referred to as a Project Initiation Request (PIR), which initially defines the capital project. However, the content and rigor involved in PIR development is often inconsistent from company to company and even from business unit to business unit (Figure 1). PIRs are important to decision makers because the information they contain forms the basis for assessing value, complexity, and early cost or schedule commitments. They also guide subsequent selection or deselection decisions. The study found that more rigorous identification supports consistent delivery to committed end dates.

Figure 1

As an industry, we have been inconsistent in managing sustaining capital project portfolios. Our reactive approach to project prioritization and resource management has led to volatile short-cycle sustaining capital project outcomes.

Industry also needs to establish methods to track capital availability in real time and to update forecasts based on integrated knowledge of progress, resource availability, and funds. Successful and consistent sustaining capital portfolio outcomes can be achieved through integrated portfolio management and adequately informed decision making. Gaining control of the sustaining capital portfolio practices will go a long way toward delivering more predictable and repeatable project outcomes.

For more information on IPA portfolio management and holistic system diagnosis, visit IPA’s Site and Sustaining Capital page.

1 Vincent Mouraï and Ray Rui, The Neglected State of SSC Projects, UIBC 2016, IPA, November 2016.