Re-Evaluating Owner’s Cost KPIs and Cost-Cutting Strategies: When Is Enough Enough?

Research Study Call for Participation

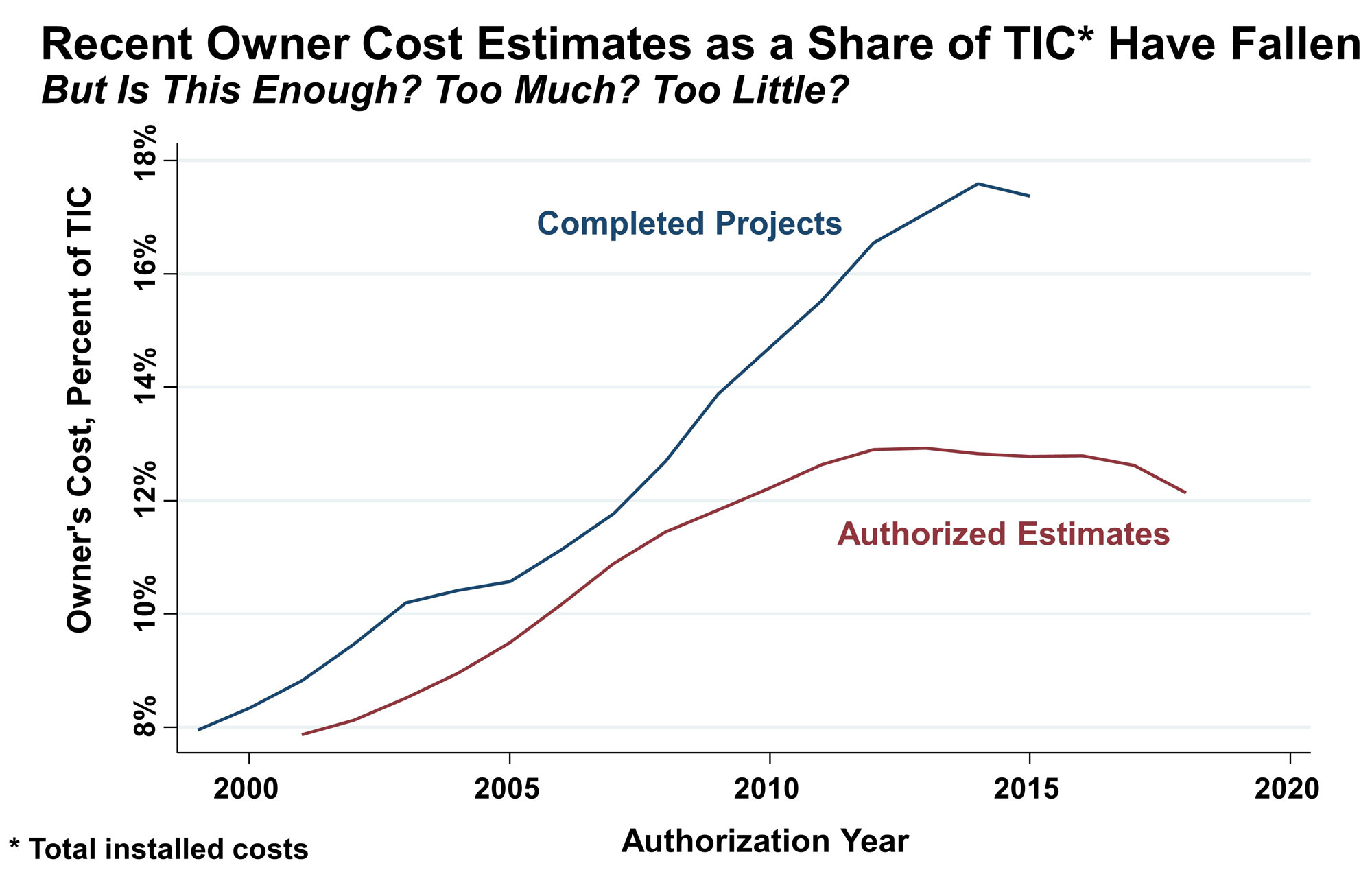

The oil price drop in 2014 exposed several weaknesses in the E&P Industry. Development solutions had become over-designed and the supply chain had been stretched and strained to meet demand. Importantly, the industry also came to realize that the one expense growing faster than supplier prices was owner’s costs. Since the 2014 downturn, E&P companies have put significant effort into cutting costs, especially owner’s costs. Less effort, if any, has gone into investigating the effect such cost cutting measures have had on project performance and whether owner cost thresholds, which are usually a simple ratio of owner’s costs as a percentage of total installed costs, are actually appropriate.

Misplaced Pressure to Reduce Owner’s Costs?

Although many companies have adopted simple owner’s cost Key Performance Indicators (KPIs) and do-not-exceed thresholds, it is time to pause for a moment and remember what owner’s costs are actually capturing. The details of the code of accounts for owner’s costs vary across the industry, but at the most basic level, these costs cover money spent on owner personnel, studies, permitting, and other costs in support of planning and executing projects. Invariably, it is those owner personnel, or project team costs, that make up the largest proportion of owner’s costs. When project leaders and teams are under pressure to reduce owner’s costs, team resources are the first to go. As anyone involved with capital projects knows, the required size and composition of a given project team is dependent on the project’s context and complexity. The team required to achieve success on a subsea tie-back to a local host, for example, looks very different from the team needed to handle a complex new development in a frontier region. Other than perhaps those companies that have truly mastered the art of standardization and repeat supply chain projects, it is hard to believe a single owner’s cost or team size metric could truly be relevant across a portfolio of projects.

IPA research has revealed the folly of adhering to a single owner’s cost KPI to reign in project costs. For example, a design competition contracting strategy might succeed in increasing a large capital project’s cost competitiveness compared to the industry average for similar projects. But consider the owner’s costs involved in carrying out a design competition. How much does it cost for owner project team personnel to review Front-End Engineering Design (FEED) packages delivered by multiple contractors? What are the chances that the owner’s cost wrapped up in this contracting strategy would exceed a single KPI intended to keep the owner’s costs in check? What about new technology? Many tout the potential of new technology to improve capital project cost outcomes. In some cases, maybe it is possible. But what is the effect on owner’s cost? Perhaps more spending on studies or permitting is necessary. Could the total asset cost advantages predicted with a new technology outweigh the likelihood of exceeding owner’s cost thresholds?

Moving Beyond Simplistic Owner’s Cost KPIs

Holding projects to simple owner’s cost or owner team size KPIs is an overly simplistic approach. Such metrics do not account for the relative value return on owner’s costs in different contexts and provide no guidance on how resources should be effectively dispersed across a project portfolio. IPA’s research has demonstrated countless times that strong teams are essential to project success and, when asked, most owners agree. In an environment in which E&P companies are focused on maximizing project value and optimization exercises, we cannot afford to underestimate the value our people bring to projects. No longer can we think about owner’s costs and project teams in isolation.

IPA has launched the next step in our series of research into owner’s cost to help companies understand and manage these costs in a more holistic way. The objective of this study is to better understand how E&P organizations can pursue better project staffing strategies—strategies that leverage owner competencies, suit the project context, balance owner costs, and ultimately promote project success. These insights will equip owners with the ability to make smart decisions around staffing projects and optimizing resources across their portfolios, while maximizing the competiveness of owner’s costs for a given development.

Achieving this objective requires that we understand the strengths and weakness of various project staffing models employed by owners and the relationships between these staffing models, owner’s cost, and project outcomes. This understanding will allow us to explore questions, such as:

- When are lean teams appropriate and how can they achieve success?

- When are more robust teams with higher owner’s costs more cost effective at the project level?

- What owner cost KPIs give a more nuanced assessment of a system’s health?

Our study approach is collaborative, combining IPA’s expertise on E&P projects, research design, and analytics with close interfacing between IPA and study participants to share early findings in real time, gather feedback, and ensure study results are highly contextual. The result will be a customized report for each participating client, detailing insights generated through the study analysis and a system diagnoses aimed at answering the following questions:

- Is your project system using the most suitable staffing models?

- Are you maximizing the effectiveness of the staffing models you use or missing out on key points of leverage?

- Are you leaving money or performance, or possibly both, on the table? Given the constraints and context of your system, what action can you take to close these gaps or activate value levers?

For more information on how you can participate, please complete the form below.

Written by Katya Petrochenkov and Tom Mead, the study’s principal investigators.