Changing Portfolios Require a Robust Development Process

Growth and new types of projects are changing the portfolios for many companies that execute capital projects. This was the main finding of a breakout session at IPA’s annual meeting of the Industry Benchmarking Consortium in March 2023 (IBC 2023) in which IPA clients shared the challenges they face in establishing and managing their capital project portfolios.

The breakout session involved project professionals who are involved in their company’s portfolio process. A third of the breakout session attendees are directly involved with establishing and developing their company’s portfolio, while another third contribute to portfolio decision making. The remaining third have less decision-making authority but provide information to develop their company’s portfolio and are affected by high-level portfolio decisions.

The Role of Portfolio Management

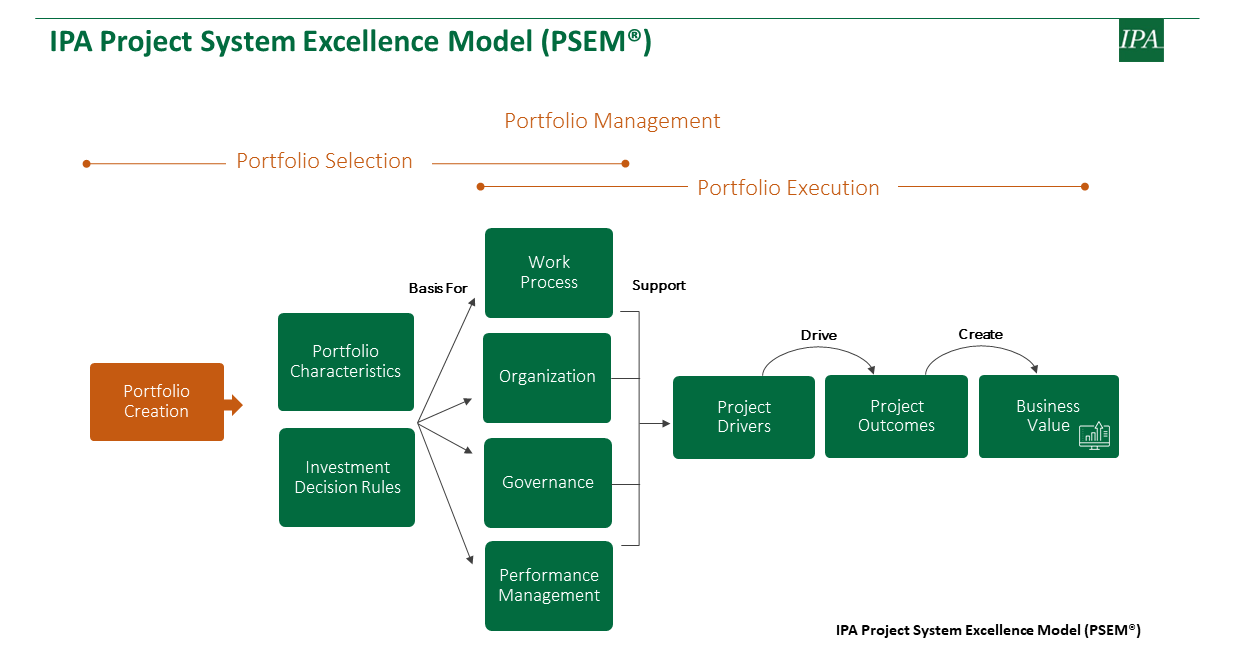

Our goal for the breakout session was first to explore the role of portfolio management in achieving project system excellence. What we need and want our project system to do is fundamentally driven by the portfolio of projects that the company plans and executes. And, as shown in IPA’s Project System Excellence Model (PSEM®) framework, portfolio creation (selection of opportunities) kicks off the process that eventually results in business value delivery by the company’s projects.

Our overall objectives for the session were to:

- Understand industry approaches and norms to establish and manage the portfolio

- Identify current and potential portfolio creation Best Practices

- Consider those aspects of portfolio management, focusing on portfolio creation, that maximize the value a company can realize from its capital investment

- Generate a framework or model for portfolio management excellence, starting with portfolio creation

Fit-for-Purpose Project System

A project system must be fit for purpose. A project system that is too onerous or does not fit with the company’s organizational structure—even if it reflects industry Best Practices—will not be implementable. For a system to be truly usable, it must avoid being bureaucratic and focus on being value adding. But the process and organization cannot become so simplified that the system does not meet its purpose, which is to provide the mechanisms—instructions, assurance, and competencies—to drive successful projects. The system must consider the businesses it serves and what outcomes are expected or required to make projects successful.

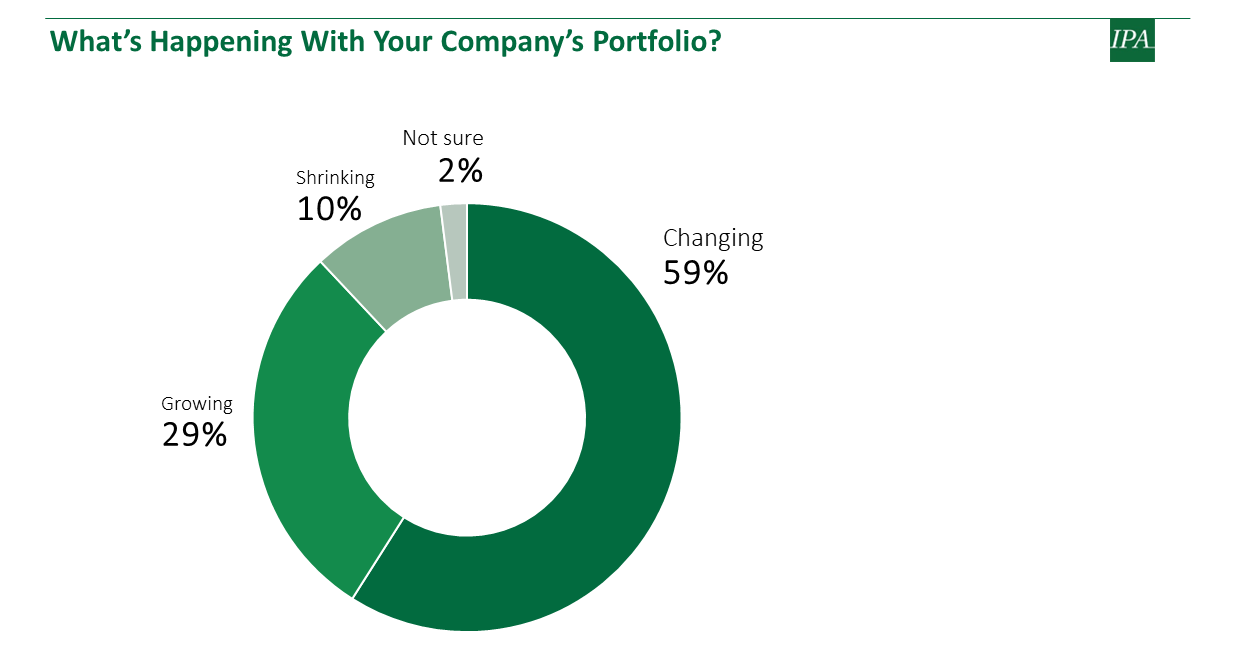

As companies deal with rapidly changing portfolios—including new energy and sustainability projects, new products and new regions, portfolio growth, or scaling back—this fit-for-purpose quality becomes even more important. In our breakout session, 59 percent of participants indicated that their company’s portfolio was seeing significant changes, including incorporating new businesses, technologies, or products. In addition, for those whose main businesses are not changing, 29 percent said their portfolios are growing.

Portfolio Creation Objectives

The goal of portfolio creation should be to maximize the value of a company’s capital investment. There are several important things to keep in mind while developing a portfolio. The best fit-for-purpose portfolio generation process will:

- Identify the most valuable opportunities: This entails connecting the portfolio strategy to the company’s capital investment to achieve company goals through capital expenditure.

- Develop a robust basis for selecting the right opportunities and deselecting the wrong ones: This portfolio assessment step must identify potential returns (value) and risks for informed decision making to maximize value delivery.

- Promote capital governance: Enhance transparency and accountability for capital investment decisions. Obtain buy-in from all internal, legitimate stakeholders as starting point to provide a stable foundation for project planning and execution.

- Leverage (often limited) resources: For optimal project performance, the portfolio system must make the best use of the available resources.

Portfolio Creation Workflow

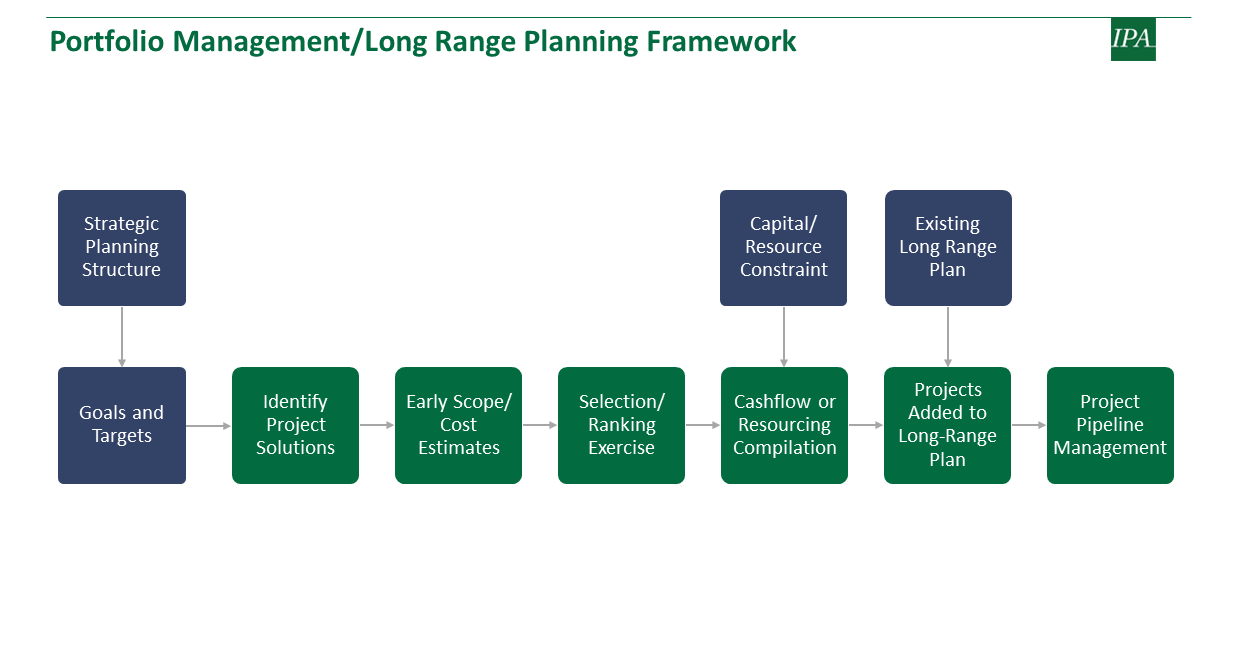

Determining the investment needed to deliver strategic goals and meet regulatory compliance and facility reliability sustainment investment needs is a difficult task. The process is summarized in the Portfolio Management/Long Range Planning Framework shown below.

Starting with the first element in the framework, effective portfolio creation requires effective strategic planning that provides goals and direction. However, when asked to describe the strategic planning structure of their company, more than half of our breakout session participants said that their company structures and processes for defining strategy were missing key elements and that it was unclear how the elements (strategies, assessments, plans, etc.) come together to fully inform portfolio decisions. Only 14 percent said their company had a well-defined strategic planning structure, with about a quarter of respondents saying the structure was defined but missing key elements. In other words, the majority found their company’s portfolio strategic planning structure to be lacking.

As shown in the framework, portfolio creation then requires that some important questions are answered:

- Is there a clear definition of success for capital investment?

- Where, within the organization, are portfolio goals set?

- Does the company have both corporate and business goals?

- How are facility needs brought into decision making?

From this starting point, companies identify project solutions, develop cost estimates and early scope for these projects, and select which to move forward by ranking the opportunities against each other. Decisions made here can be affected by capital or resource constraints and feed into the company’s short- and long-term financial plans.

Each element in the Portfolio Management framework poses challenges to effective execution. In subsequent articles in this series, we will discuss these challenges as well as Best Practices as we examine each element in detail first for site-base/small project portfolio management and then for large project portfolios.

Contact IPA to discuss your portfolio management challenges.