IPA Completes Comprehensive Study of China-based EPC Contractors in the Global Projects Marketplace

China-based engineering, procurement, and construction (EPC) contractors are recent arrivals to the global contracting marketplace.

Most of the capital projects Chinese contractors have supported outside of China are located in developing countries, especially in Africa and Central Asia1. However, since 2000 when the Chinese government began pushing its “Go Global” investment strategy, Chinese EPC contractor activity in the global projects marketplace has steadily increased.

China-based EPC contractors may become vital project resources in the future global EPC services marketplace. Chinese contractors are steadily gaining project work experience inside and outside China. Meanwhile, the demographic challenges of an aging engineering workforce that North America and Europe face in the next couple of decades create an opportunity for new players. Learning to work with Chinese contractors effectively now, when their comparative costs are still low, may provide owners future strategic advantage.

In addition, Independent Project Analysis (IPA) observes that when Chinese owner companies are doing joint-venture projects with non-Chinese owner companies—and the project is in a location where the Chinese owner has previous project experience or where neither party has a clear location advantage or monopoly—the Chinese owner often favors using its own China-based contractors for some or all project activities. Non-Chinese owner companies stand to benefit from understanding the capabilities and the weaknesses of the Chinese contractors in advance. That way they can better ensure any required mitigation strategies and related management expenses are in place as part of pre-joint venture negotiations.

Because owner companies are showing increasing interest in using Chinese contractors in other parts of the world, either as standalone owners or within joint ventures with Chinese owners, IPA set out to examine several issues regarding the strengths and weaknesses of using Chinese EPC contractors for the development and execution of capital projects.

IPA’s study was based on IPA’s database of projects executed by owners using Chinese contractors outside of China in the process industry and IPA’s discussion with Chinese company representatives. The study was further supplemented with public data and information sourced from both inside and outside China, including lessons learned captured by Chinese contractors and presented at the China Institute of Project Management in China.

As a result of the study, IPA can now quantify the potential cost savings associated with engaging Chinese contractors. IPA can also discuss methods that owner companies use to select and manage these contractors, with specific examples to examine success factors for these strategies.

As noted before, Chinese owners and contractors have been working outside China for a decade, especially in developing regions in Africa and central Asia. Therefore, the Chinese have been building capability to compete with their international counterparts, especially in regions in which the regulatory and environmental regimes closely resemble the Chinese domestic scene.

Additionally, compared to more established providers of EPC services with headquarters in North America, Europe, and Asian nations such as Japan and South Korea, Chinese EPC contractors are often regarded by owner companies as being potential low-cost alternatives for capital project services.

But while China-based EPC firms may deliver certain project cost savings, IPA found that the value is only realized when the owners assign additional project management and construction management resources to their projects. Therefore, even though the overall project cost tends to be lower using China-based EPC firms in projects outside China, the magnitude of overall cost saving is often less than estimated with additional owner costs incurred during the execution phase.

These findings are aligned with those for projects executed by non-Chinese owners in China—the first project is unlikely to fully realize the potential benefits (especially cost savings) of using Chinese contractors.

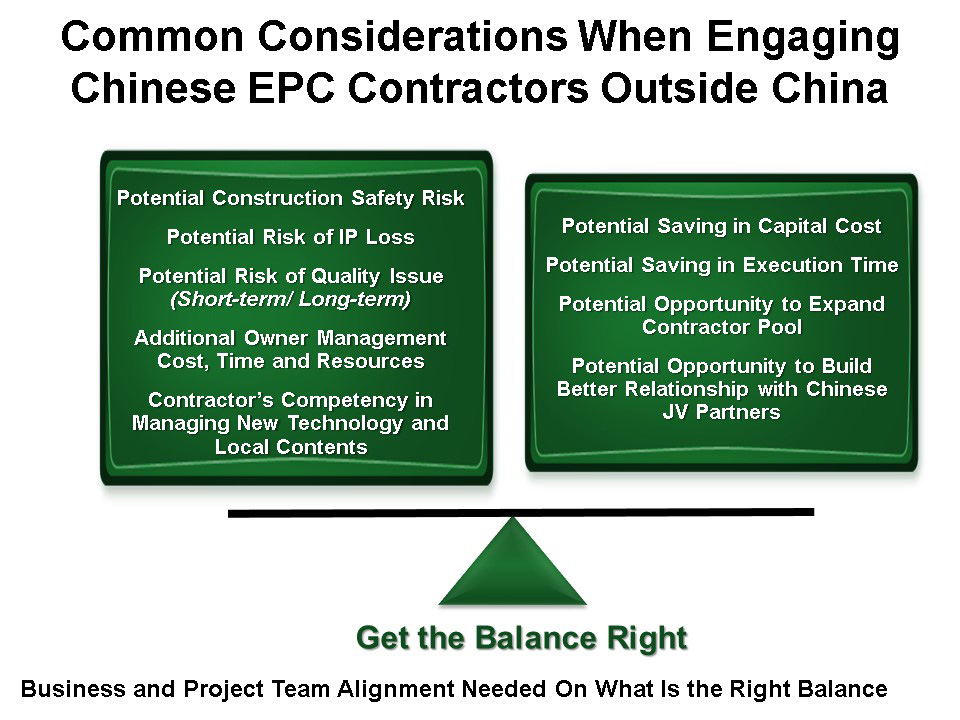

Of course, other than the potential cost saving achieved by engaging Chinese EPC firms, there are other considerations supporting and discouraging the use of Chinese EPC firms for projects outside of China. Some of the commonly cited considerations when engaging Chinese EPC contractors outside China are shown in the figure (right).

Selected Study Highlights

Project scope and size, innovative technology, intellectual property protection, and the level of local content required as stipulated by the host country are among the project issues organizations should consider when selecting EPC service companies.

In particular, owner companies should:

- Set realistic expectations when engaging contractors in relation to safety/cost/schedule/quality tradeoffs. Contractors may appear to provide a cost advantage but owners must be proactive to manage the weaknesses (e.g., quality issues) of the contractors to ensure the cost savings can be realized.

- Staff project teams appropriately during FEL to address specific challenges associated with the use of EPC contractors during project execution.

- Understand the general strengths and weaknesses of contractors so specific risk management activities can be developed to manage them effectively.

- Proactively support contractors to manage local content requirements, as contractors tend to struggle with local issues such as obtaining local permits and managing local environmental and industrial relationships.

- Avoid using a EPC contractor if protecting intellectual property (IP) is a concern or prepare for the additional management efforts required and cost involved in setting up an IP protection management plan appropriate for the project.

Accessing the Study

For further discussion of your strategy to use Chinese contractors outside China, please contact our Asia-Pacific office.

1 Peter Reina and Gary J. Tulacz, The Top 225 International Design Firms – Competition on the Rise, ENR, July/August 2014