IPA Unveils Tools for Improving the Carbon Competitiveness of Capital Projects

The pace with which energy, refining, chemicals, mining, and other industrial sector companies are investing in projects to reduce their carbon footprints is quickening. Decision makers understand that successful decarbonization projects are imperative to the implementation of high-profile corporate sustainability initiatives. Lowering the carbon intensity of projects is the right thing to do, but the question decision makers rightly ask is: “At what price?”

An IPA assessment of lower-carbon projects shows that business leaders are having a difficult time determining how they can strike the right balance between (lower) carbon intensity and project costs. Data from decarbonization projects IPA has evaluated over the last two years show that projects either meet lower carbon-intensity expectations but end up costing significantly more than promised, or the projects are cost competitive but fall short of their carbon reduction goals. Part of the reason for the uneven outcomes is that decision makers lack standardized tools rooted in real project outcome data to support their investment decisions.

Recognizing the need for business and project teams to quickly access the independent and reliable information necessary to assess the competitiveness of lower carbon projects, IPA has added new capital project assessment capabilities to its portfolio. IPA has also developed a new assessment readiness framework designed for greenhouse gas (GHG) emission reduction projects.

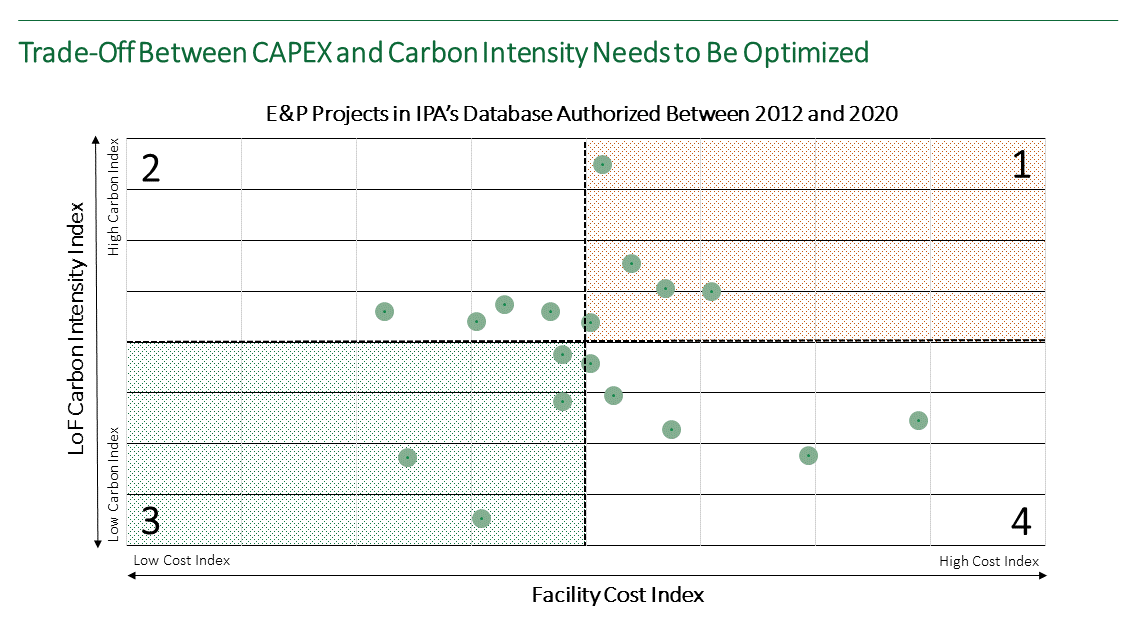

The Carbon and Capital Effectiveness (CCE) Index helps business and project teams compare low-GHG development options against the industry average as well as a portfolio of opportunities. According to IPA Advanced Associate Research Analyst Adi Akheramka, the lead researcher for low-carbon evaluation metrics, the CCE metric empowers project teams to present the business with an optimal balance between the cost and carbon competitiveness for a development concept (Figure 1). Teams can understand the trade-offs between carbon intensity and facility cost values derived from IPA’s actual project data. They can also weigh how individual low-carbon opportunities compare with other opportunities in their company’s portfolio and other similar opportunities in the industry.

The CCE metric is built on a separate new metric that leverages proprietary data to measure the carbon performance of projects, IPA’s Life of Field (LoF) Carbon Intensity metric. The LoF Carbon Intensity metric serves as a pre-concept select tool for target setting, concept screening, and early estimate benchmarking of opportunities independent of their design characteristics. More than a half dozen national and regional standards and methodologies for estimating carbon dioxide equivalent (CO2eq) emissions were reviewed to normalize the data from different companies as part of IPA’s research, Akheramka said. IPA’s pre-concept select tool provides both industry average absolute CO2eq emissions and carbon intensity in kg CO2eq/BOE (e.g., kilograms CO2eq per barrel of oil equivalent).

The CCE and LoF Carbon Intensity Index metrics were incorporated into IPA’s Decarbonization Readiness Assessment Framework. The framework can aid teams with assessing the maturity of their GHG estimates and guide the use of effective practices for the deployment of lower carbon-intensive asset developments. According to David Rosenberg, IPA Senior Research Consultant, the framework is meant to allow individual project teams to “effectively employ GHG and carbon reduction practices to deliver low carbon-effective capital projects.”

The metrics and tools, presented for the first time during a virtual Upstream Industry Benchmarking Consortium (UIBC) 2020 presentation, were developed in collaboration with the Joint IPA-Industry Carbon Working Group organized by IPA. The group kicked off its work earlier in 2020 with a project decarbonization survey that highlighted gaps between corporate visions and “on-the-ground project readiness” of planned capital investments.

The metrics and framework are ready for use by teams working toward delivering low-carbon projects in the upstream oil and gas sector. IPA is currently working to extend the application of the metrics to support project teams responsible for optimizing carbon competitiveness and capital effectiveness in the chemicals, refining, mining, and other sectors. The IPA tools enable businesses to evaluate projects at the critical concept select stage, early enough to enable change to help control carbon and cost performance.

Contact us for more information on IPA’s new tools for improving the carbon competitiveness of capital projects.