Current Market Trends in Capital Projects

My group of researchers in IPA’s Cost Group routinely monitors specific economic trends that IPA has long linked with capital project behavior and performance. Economic shifts influence capital portfolio decision making and that impacts project outcomes. Closely tracking economic metrics is also critical to the accuracy of IPA’s project risk evaluations and benchmarks, making sure the appropriate escalation metrics and supply chain patterns are taken into account. Below, I provide a synthesis of key metrics and indexes we routinely monitor to give some insight into current market trends in capital projects.

Market Overview

Economic data released over the past few months show a slowing global economy as rising energy prices and supply disruptions have resulted in high and broad-based inflation. The ongoing Russian invasion of Ukraine has triggered a costly humanitarian crisis, and economic damage from the conflict will contribute to a significant slowdown in global growth in 2022. The IMF Outlook[1] expects global economic growth to slow from about 6 percent in 2021 to 3.6 percent in 2022, which is significantly lower than the 4.9 percent global economic growth forecast in October 2021. Similarly, the World Bank has lowered its global growth forecast for 2022 to 2.9 percent (the January forecast was 4.1 percent).

Rise in Inflation Puts Pressure on Central Banks

Even as the war reduces growth, it will continue to add to the inflationary pressures that have been in ascendance since early 2021, driven by rising commodity prices and pandemic-induced supply-demand imbalances. U.S. Consumer Price Index (CPI) figures showed an 8.5 percent increase for the 12 months ending in July 2022, while the Euro Area annual inflation rate increased to 8.9 percent. This elevated inflation is complicating the trade-offs central banks face between containing price pressures and safeguarding employment and economic stability. Interest rates have started to rise in the United States and United Kingdom as central banks tighten policy, which is exerting pressure on emerging markets and developing economies. In addition to the war, frequent and wider-ranging lockdowns in China—including in key manufacturing hubs—have also slowed activity there and could cause new bottlenecks in global supply chains.

Increased Capital Investment Supported by High Commodity Prices

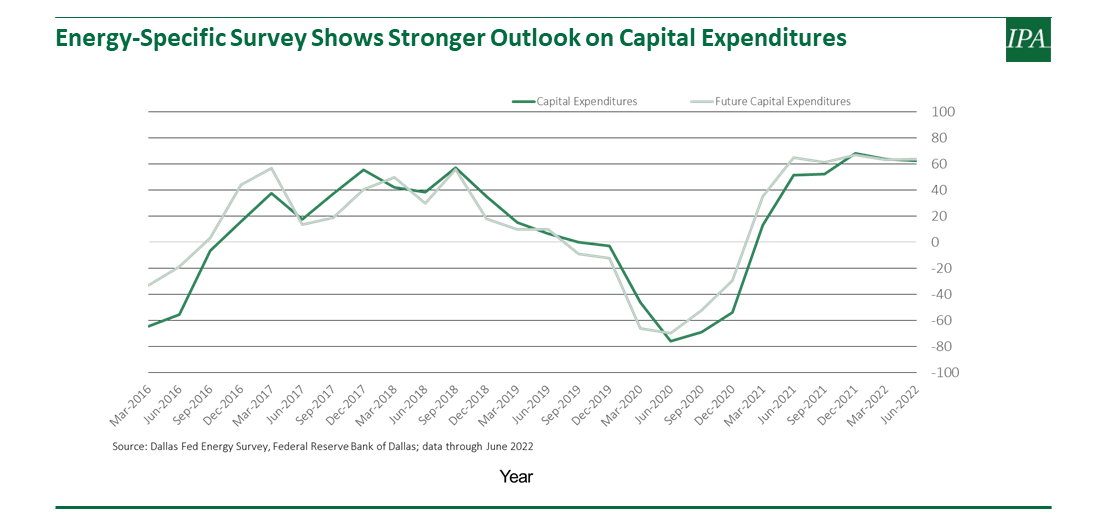

Higher commodity prices should be supportive of increased capital investment in the industrial sectors, but business uncertainty continues to be high, driven by rising instability in financial markets, slowing global growth, China’s lockdowns, and Russia’s invasion of Ukraine. However, there are some good signs of increased capital investment as shown in the Federal Reserve Bank of Dallas’ (Dallas Fed’s) Texas Energy Outlook Survey. The Dallas Fed conducts a quarterly survey of about 200 oil and gas firms located or headquartered in the eleventh district—Texas, southern New Mexico, and northern Louisiana—that operate regionally, nationally, or internationally.

Based on the Q2 survey results reported on June 23, 2022, activity in the oil and gas sector expanded at a robust pace, according to oil and gas executives responding to the Dallas Fed Energy Survey. The business activity index—the survey’s broadest measure of conditions facing eleventh district energy firms—edged up from 56.0 in the first quarter to 57.7, reaching its highest reading in the survey’s 6-year history and indicating strong business conditions. The figure below shows that the capital expenditure and future capital expenditure indices continue to stay at historically high levels since the survey began tracking these data in 2016.

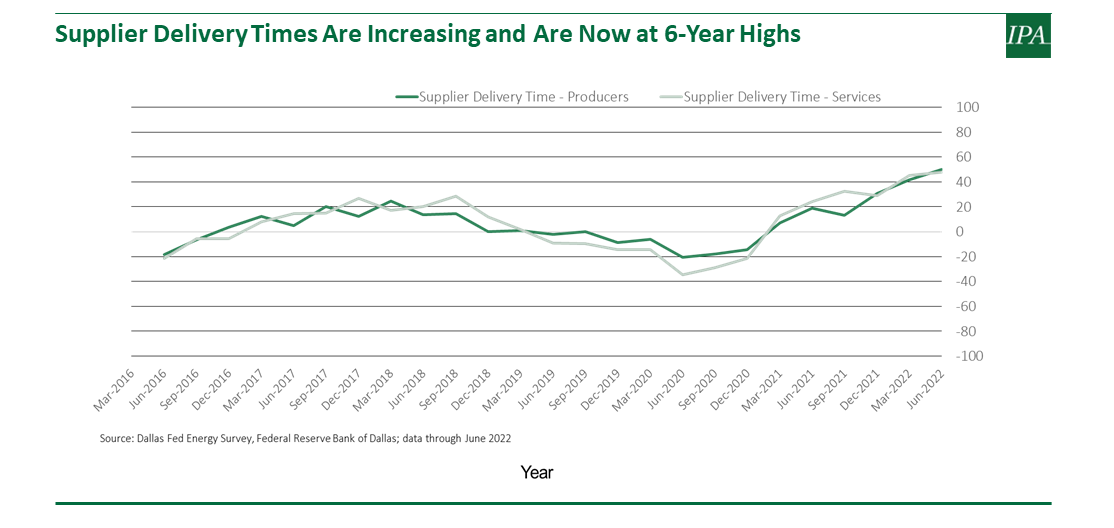

Supplier Delays at an All-Time High

As shown in the figure below, the survey also showed that it is taking longer for firms to receive materials and equipment. The supplier delivery index for oil and gas producers increased from 41.6 to 50—a record high. Among oilfield service firms, the supplier delivery index edged up from 45.4 to 48.0—also a record high and suggestive of delays acquiring products and/or services.

IPA is also observing similar trends in cost escalation and supply delivery delays from the information gathered directly from project teams across the process industries as part of project evaluations. Based on IPA data, composite prices for a standard onshore facility grew at an 8 to 10 percent annual rate in 2021, while offshore facility costs grew 11 to 13 percent in the same period across the major global regions. The primary contributors to the significant price increases are rising equipment and bulk material prices, with engineering services and field labor costs growing at a much more modest pace.

Based on a survey IPA recently conducted of E&P companies, offshore facility costs increased by about 10 percent in 2021, driven by a 25 percent increase in bulk materials (pipe, electrical, instrumentation, steel) and 15 percent increase in equipment costs.

The survey also showed E&P companies are expecting some slowdown in price increase rates (albeit, they will still be at high levels compared to historic levels) in 2022 (6.1 percent), further slowing to 4.5 percent in 2023. We are beginning to see some pull back in commodities, as shown by a 15 percent pullback in the World Bank’s Metals & Mineral Index since the last peak recorded in March 2022. The Metals & Minerals Index had increased by 115 percent over a 2-year period after bottoming in April 2020, which was in the early days of the pandemic.

Downstream Market Trends

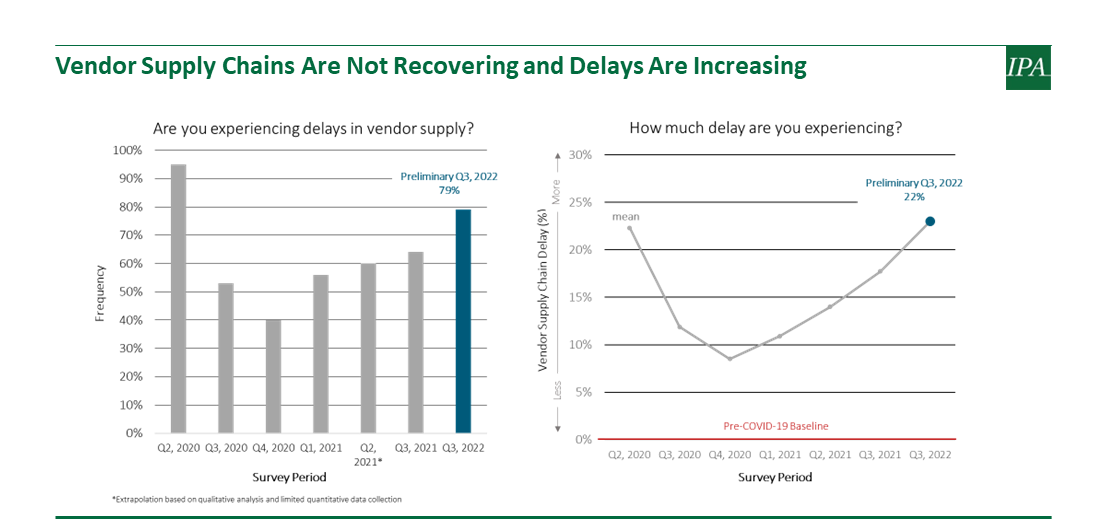

IPA is also conducting a market trends survey focusing on downstream (refining, chemical, consumer products, life sciences, mining, etc.) companies and we are witnessing similar themes in the survey responses. As shown in the figure below, 79 percent of the survey responses collected thus far are reporting delays in vendor supply, and the average delay has gone up to 22 percent (relative to the 2019 baseline). Procurement delays are reported to be significant across regions and types of materials, especially fabricated equipment, specialty valves, and almost all types of electrical equipment. Owners are also reporting issues with engineering delays, as 36 percent of the companies reported experiencing higher delays in engineering than in 2019, with the average reported delay of 15 percent. Sixty percent of the owner companies also reported that they are concerned about how engineering companies are likely to respond when project activity ramps up, which is 8 percent higher than the average response received in the last survey done in September 2021. The survey also showed that there are significant concerns around the market availability of qualified and experienced engineering resources, which is hampering the recruitment efforts.

We will be finalizing the survey over the next few weeks and will be presenting the final results at IPA’s Cost Engineering Committee meeting in September.

Overall, we expect inflation to remain elevated above recent historical norms for some time, but the rate of change should moderate from the extremely high growth observed over the past 12 to 18 months, which was driven by supply chain issues, commodity price increases, and broadening price pressures. The medium-term trajectory of inflation is extremely uncertain and downside risks to the global outlook dominate—including from an escalation of the Ukraine crisis, increased sanctions on Russia, sharper-than-expected deceleration in China driven by the continued strict zero-COVID-19 strategy, and renewed flare-up of the pandemic.

[1] International Monetary Fund, “World Economic Outlook Update, April 2022: War Sets Back the Global Recovery,” April 2022, accessed June 27, 2022, at https://www.imf.org/en/Publications/WEO.