The Domino Effect of Cash-Flow Restrictions on Projects

Every capital project plan carries with it a particular pattern of cash expenditure derived from the project’s schedule and the peculiarities of the vendor and contractor markets and contracting strategy. More and more often in recent years, businesses have found it expedient or necessary to alter cash flow on projects to conserve cash in a particular calendar quarter or calendar year. Past IPA research has outlined the actual effects cash flow constraints have had on project outcomes.

As market forces strain companies and cash flow restrictions re-emerged as a tool businesses use to cope, we look back at the effects these constraints have had on project results. While such restrictions may be necessary, recognizing how such restrictions affect project results gives businesses the information needed to make these types of trade-offs.

What Is a Cash Flow Constraint?

Every capital project has a spending pattern that is synchronized with the project’s schedule strategy. A cash flow constraint occurs whenever spending must be slowed to meet a non-project requirement. For IPA’s definition, this must be after authorization to qualify. It must be important enough for the project manager to mention it as a management issue.

Study

We limited our analysis to projects >$5 million because cash flow (and other resource) constraints are so common among smaller projects that effects would be difficult to discern. We selected 90 projects with complete outcomes information in which cash flow constraints were listed in the documentation. We developed a control set of more than 2,000 projects of similar characteristics that did not experience cash flow constraints. We then sought to understand whether the cash flow constrained projects had any special characteristics that could cause different results.

Nature of Cash Flow Constraints

We only examined cash flow constraints that occurred after authorization; however, cash flow begins to affect outcomes starting in FEL 3. Most common is to slow the rate of spending in the second half of a calendar year by:

- Slowing engineering and delaying getting into the field

- Delaying the arrival time of major equipment to push payment into the next year

- Slowing down payments to vendors/contractors

- Slowing down the rate of activity in the field

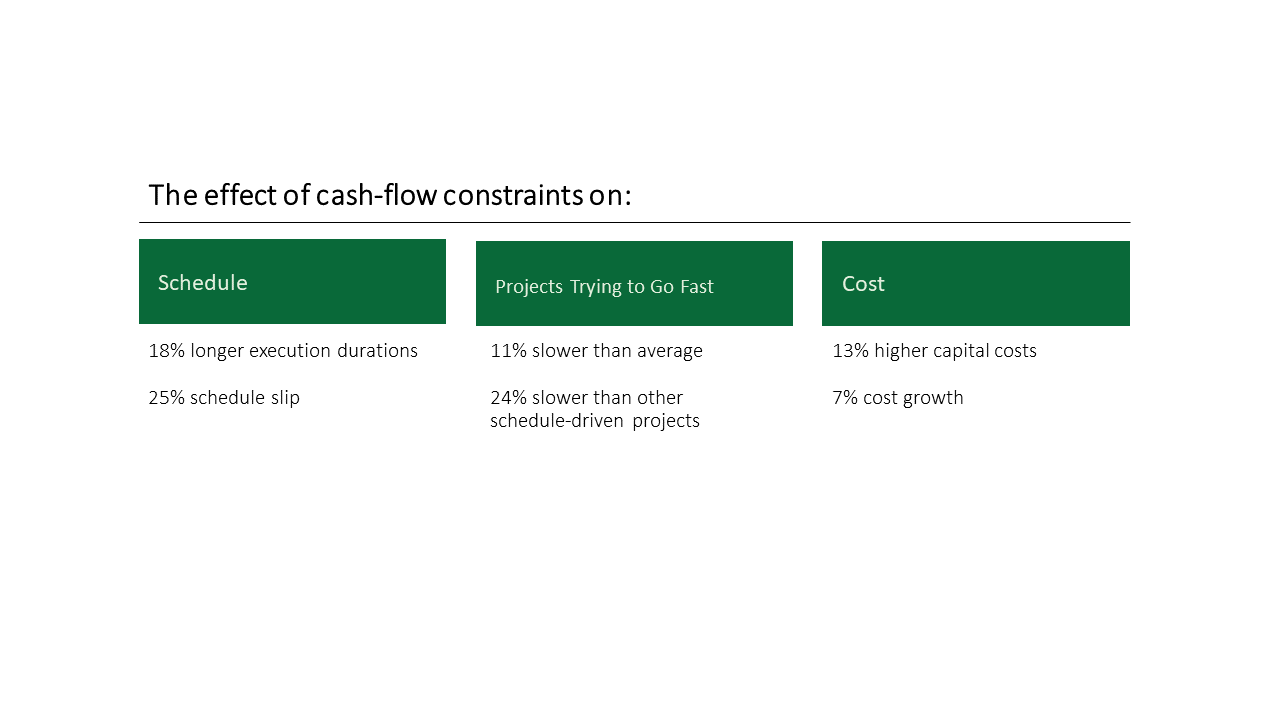

How Cash Flow Constraints Affect Schedule

Our study found that cash flow constraints add 18 percent to project execution time and projects with such constraints have 25 percent schedule slip.

What If I Want to Go Fast Too?

A schedule-driven project is one in which speed is the primary business objective and the business is willing to trade cost for speed. One-fifth of cash flow constrained projects were also schedule driven. The typical schedule-driven project that is not cash flow constrained does not slip and is completed in 87 percent of industry average time (i.e., 23 percent faster than average). Cash flow constrained schedule-driven projects (21 percent of all cash flow constrained projects):

- Had an average schedule slip of 23 percent

- Were 11 percent slower than industry average

- Were 24 percent slower than other schedule-driven projects

What Is the Cost of Cash Flow Constraints?

Cash flow constrained projects had 13 percent higher capital costs on average and 7 percent cost growth on average.

Why Such Large Effects?

Schedule and cost cannot be divorced except by careful upfront planning. Cash flow constraints will almost inevitably increase cost via schedule because they are unplanned. Cash flow constraints add 11 percent to construction schedule durations. Cash flow constraints are associated with increased equipment costs and lower labor productivity. The effects are often difficult to foresee and difficult to explain to those unfamiliar with projects.

What Are the Business Effects?

For the average cash flow constrained project, the internal rate of return (IRR) decreases from 15 percent to 12.5 percent and net present value (NPV) drops 20 percent.

Implications

IPA’s study results are almost certainly understated. Not all cash flow constrained projects could be identified from the documentation. Often, cash flow constraints are applied to many projects in an owner portfolio, and IPA might analyze only a sample of projects.

Cash flow constraints on projects are much more damaging than previously thought. Use of capital projects for cash flow management should be a last resort.

The findings demonstrate that using projects to manage corporate cash flow is very damaging to a business. We suggest several alternatives to cash flow constraints and urge businesses to view cash flow constraint as a true last resort.