The Link Between Owner’s Costs and Mining Project Performance

Research by Jose Miguel Bolivar, IPA Senior Analyst, and Baqun Ding, IPA Mining, Minerals, and Metals Business Area Manager

Like other capital-intensive industrial sectors, mining companies have struggled to control rapid owner’s cost growth on capital projects. IPA data indicate that owner’s indirect costs have increased by more than 75 percent in two decades. Project management organizations in the mining industry have drawn heat for not keeping these seemingly value eroding expenditures at bay.

The list of factors responsible for driving owner’s costs higher, and lower, is long. Mine type (open pit or underground) and size, the existence of major infrastructure in the region and other infrastructure near the project, the owner organization structure, and project team size itself are just a few known drivers. But controlling owner indirects and other non-traditional owner’s costs entails more than just recognizing correlated project factors. What project organizations really need to understand is the extent to which owner indirects and engineering spending can impact capital project outcomes.

IPA Senior Consultant Jose Miguel Bolivar and Research Analyst Arkadi Lebedinskii have completed a multi-client owner’s cost study involving more than 110 mining and minerals projects of varying scopes and characteristics. Companies that participated in the study contributed data for five of their recently or nearly completed projects. The study participants’ more recent project data were combined with other recent mining and minerals projects data in IPA’s proprietary capital projects database.

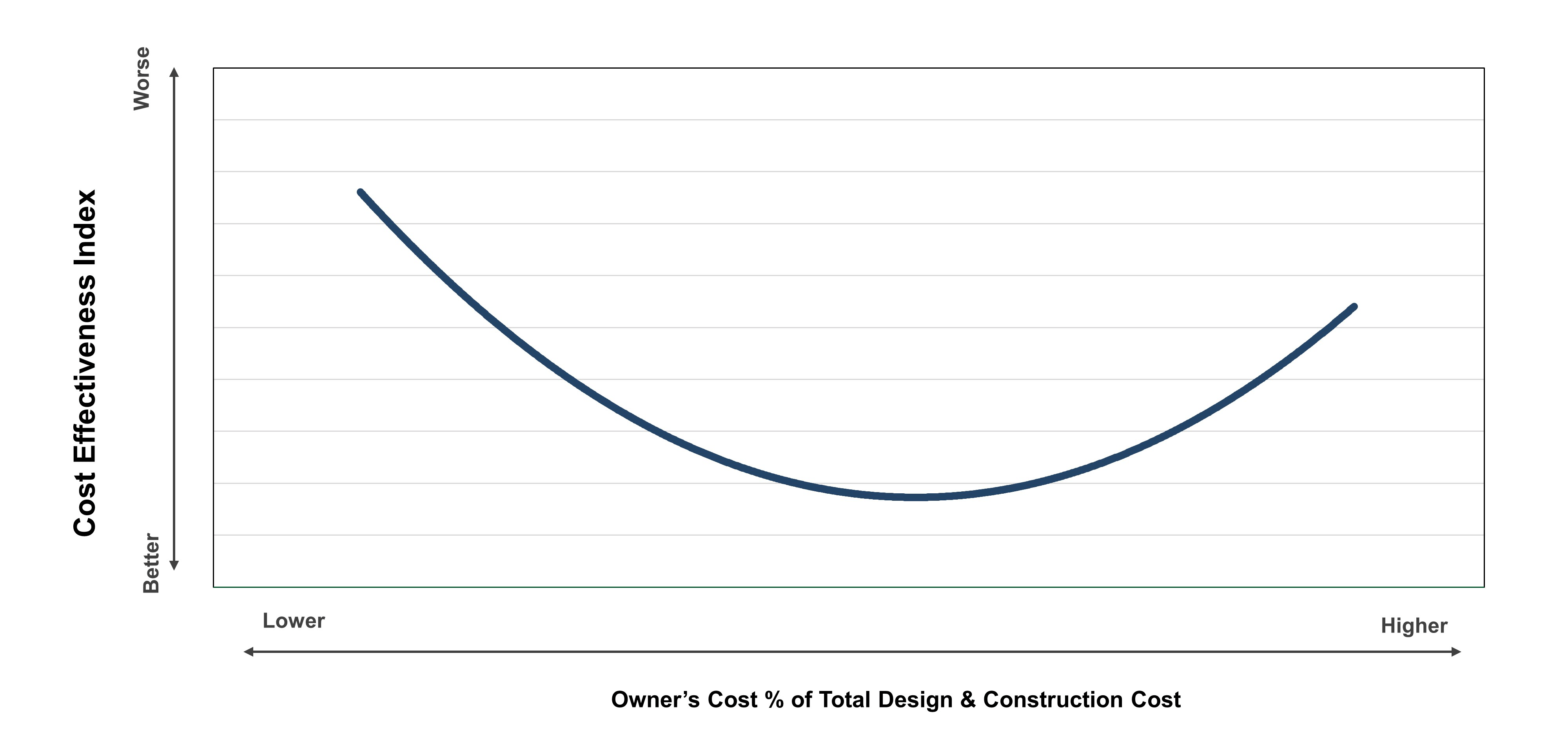

A key finding from the multi-client study is that owner’s cost spending—high or low—affects the quality of project execution planning as well as project execution effectiveness. Notably, IPA found that there is an optimal owner’s indirect and engineering cost range for projects in which quality and effectiveness improvements are possible. When owner’s costs fall within this optimal cost range, improved cost effectiveness performance can be achieved. What’s more, while the owner’s cost range varies with different categories of projects, IPA concluded that the optimal range can also be used to improve cost and schedule predictability and overall project schedule outcomes. Figure 1 is an example of the study’s findings regarding owner’s cost ranges and a project’s effectiveness performance.

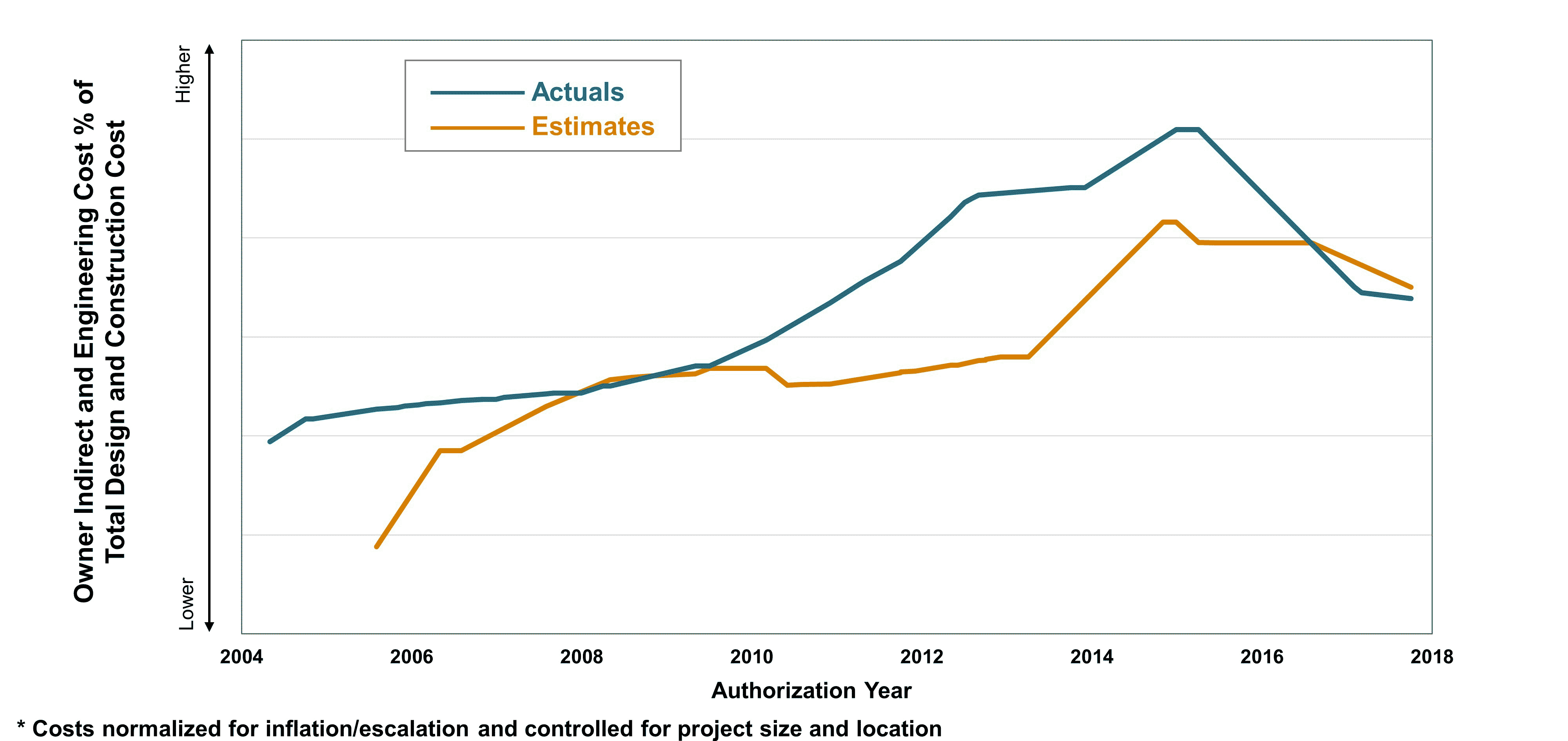

The study also produced owner’s cost spending trends for the mining and minerals industry (and also the spending trends for the individual companies participating in the study). Spending trends for typical owner indirects were created for activities such as project definition, engineering, project management, construction management, and construction services. Ten-year spending trend lines were also generated for less typical owner’s costs, including sustainability costs, community support, and operational

readiness. As Figure 2 shows, owner indirect and engineering costs doubled in 10 years, and then declined some starting around 2015.

Leveraging industry learnings for capital project developments can be beneficial to all mining companies. A mining company can use this study to diagnose its current owner’s cost allocation and spending strategy, identify factors responsible for driving such spending, and assess whether it should re-evaluate its project development and execution practices. The study is well suited for mining companies with project portfolios that include greenfield projects, brownfield projects, projects in remote areas with complex community issues, and first-to-region projects. Participating client companies simply need to contribute data for five of their recently or nearly completed projects.

Please complete the form below to request more information about this study.