The Portfolio Management Problem for E&P Companies

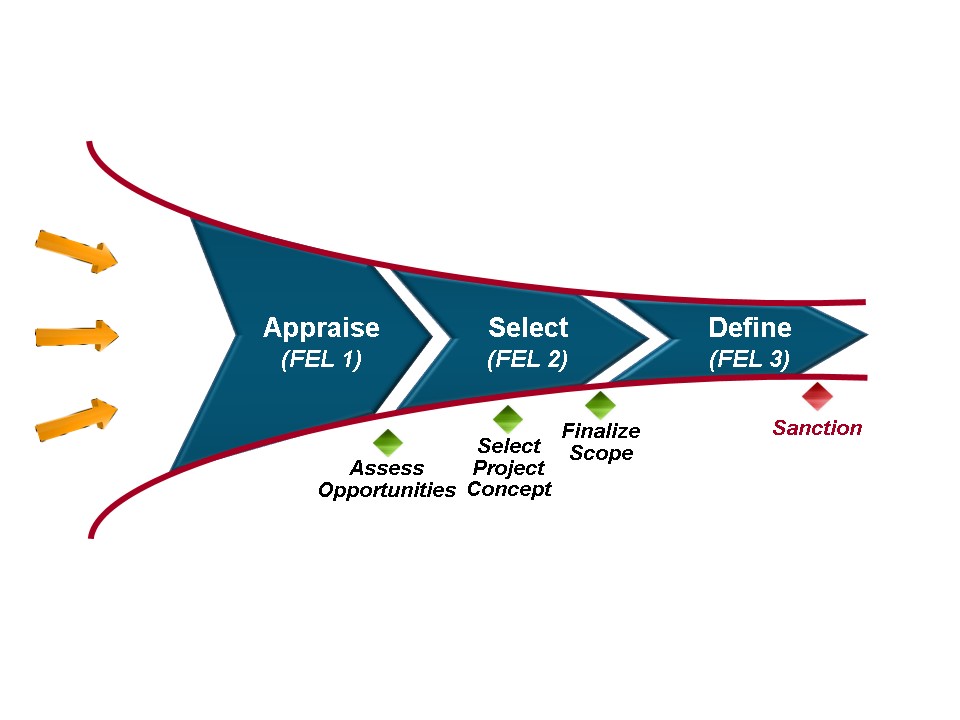

Exploration and production (E&P) companies need to manage their project portfolios better by strengthening the decision-making processes and criteria they use when deciding which projects to move through early Front-End Loading (FEL) gates.

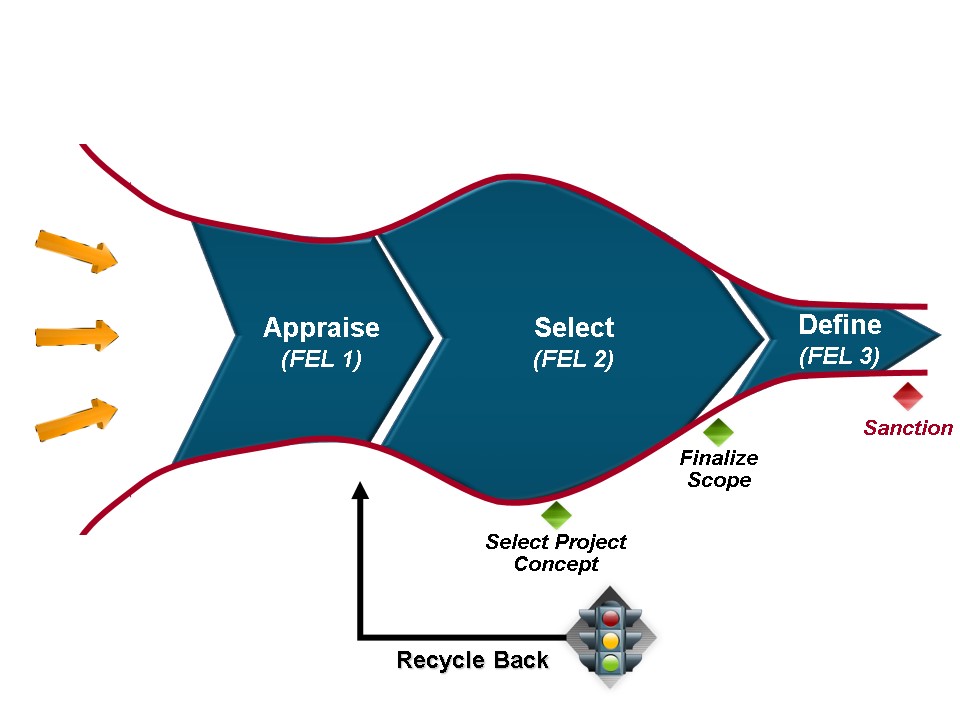

According to a recent IPA assessment of several E&P operators’ portfolio management processes, too many large reservoir projects with severe contextual problems are sailing through the project development process all the way through to Select (FEL 2) or front-end engineering design (FEED). But rather than abandoning these opportunities or resolving these context issues early, before going through FEL 1 or FEL 2 gates, companies often decide to recycle these projects far too late, overburdening their project organizations and hurting project execution results. In other words, upstream projects are being set up for failure right from the FEL 1/2 gate.

Part of the problem is the absence of key reliable data necessary to measure the true value of opportunities. Instead, optimistic early estimates regarding the size and complexity of reservoirs, for instance, are entered into sophisticated tools used by decision-makers to evaluate opportunities in a portfolio during Appraisal – FEL 1. These tools, which lend an aura of precision and sophistication, calculate decision-making criteria such as net present value (NPV), based on P50 costs, schedule and production rate data. Given the uncertainty and inherent bias of the input data, these criteria are optimistic at best and misleading at worse. Consequently, few projects, if ever, are deselected in Appraise – FEL 1. Additionally, lack of transparency in communication of project risk between project managers and executives hampers portfolio management.

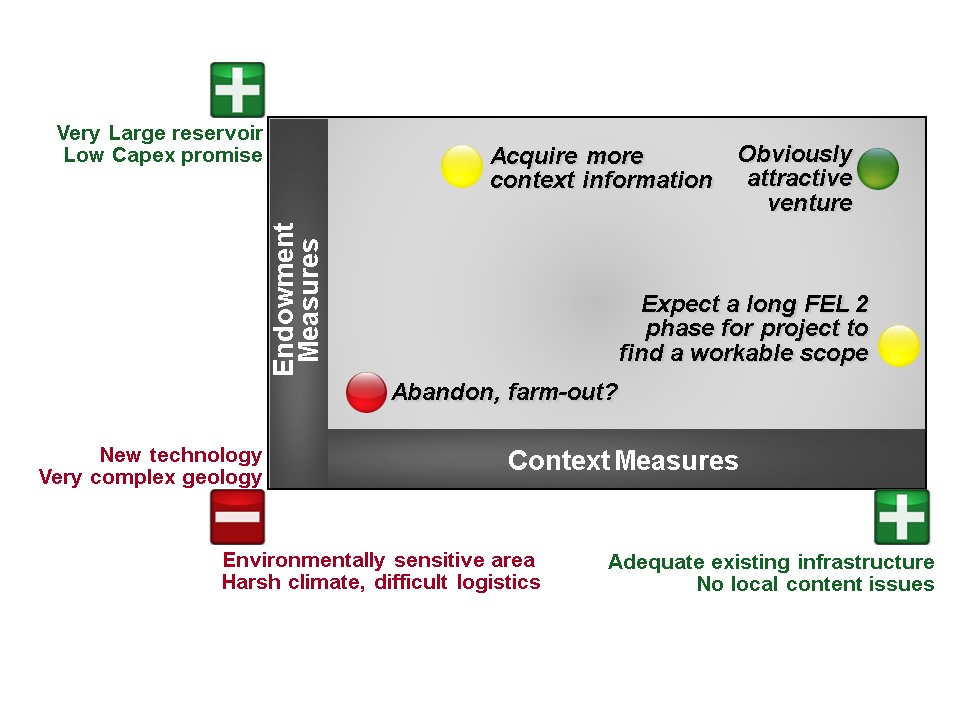

The reality is that portfolio management decisions should be based on a project’s “directional indicators”— context and endowment measures. Figure 1 illustrates the directional indicators for opportunity decision making in relation with context and endowment measures. For example, projects with positive context measures and positive endowment measures (denoted by “+”) would obviously be attractive ventures. In contrast, projects with negative context and endowment measures (“-“) should likely be abandoned. The more difficult decisions are when one measure is positive and the other is negative, with the most difficult ones being when endowment is hugely positive. This blinds decision makers into moving the opportunity forward in face of contextual difficulties.

Unfortunately, oil and gas industry’s biggest failure projects were all ones with huge positive endowment measures coupled with high contextual difficulties.

Another part of the portfolio management problem is timing. Since projects are rarely deselected moving to FEL 2 but struggle to advance out of the Select phase because of weak data and context understanding, FEL 2 usually becomes clogged with too many opportunities.

As a consequence, companies end up with bloated project portfolios. This in and of itself is a problem because project team resources are already strained. See Figure 2 and Figure 3.

Organizational effectiveness also factors into effective portfolio management, the IPA assessment found. Portfolio management is stymied when exploration and development teams are not aligned. The timing, process, and requirements for handover of project from exploration to development is often unclear since in the majority of cases there is no agreed upon definition of a project’s appraisal maturity, a critical definition for a project to proceed to FEL 2.

Effective portfolio management is also hindered by differing business unit and corporate office portfolio management goals. A business unit may be willing to pile on work on a project organization that is already overburdened, but execution results ordinarily suffer when project organizations are stretched thin working on multiple assignments. Corporate office leaders must be attuned to the politics that accompany business unit efforts to lock up project funding at the risk of taking on too many projects simultaneously.