Capital Projects in China: A Demanding Playing Field for Multinational Corporations

Multinational corporations have been adding manufacturing capacity in China for more than 40 years. The perceived size of the prize—namely a rapidly growing economy and consumer market size, as well as low engineering, materials, and construction costs—have made China an attractive investment destination for multinational corporations across a wide spectrum of industrial manufacturing sectors.

China’s gradual opening up over the past decades has added to its attractiveness among chemical, consumer products, and pharmaceutical multinational corporations. In more recent years, deregulation in the refining sector has spurred a number of proposed investments in petrochemicals by both multinational corporations and Chinese non-state owned enterprises. The Chinese government’s Foreign Investment Law, which came into force in January 2020, may also provide additional impetus to invest. In addition, government plans focus on value-added products/industries to support an innovation-driven economy and consumption-based growth. This suggests potential growth in the demand for specialty chemicals and therefore opportunities for multinational corporations with the right product offering.

However, uncertainty associated with externalities such as political tension between the United States and China, and most recently the COVID-19 pandemic, have cast a shadow on the short-term outlook of investing in China.

And while there is growth in demand-based opportunities, the rise of Chinese manufacturers is another source of pressure for multinational corporations. Their manufacturing capability has increased rapidly and they are also purported to be able to build at a fraction of the CAPEX spent by multinational corporations. Figures as low as 30 to 40 cents on the USGC dollar have been reaching the ears of senior multinational corporation executives, who then start developing similar expectations for their projects in order to increase business value. Some multinational corporations are looking into joint ventures with Chinese companies to reap the benefits of their supply chain. But even if the CAPEX values are valid, the trade-offs among cost, schedule, operability, and HSE performance are not well understood. For example, how are operability, maintainability, and production affected?

At the same time, engineering and construction costs are increasing for multinational corporations and risks such as HSE regulatory uncertainty jeopardize project outcomes. Quality delivered by vendors and contractors has certainly improved compared with a decade ago but it is not enough to guarantee success in this new environment. Success and delivery of business value require greater rigor in the way multinational corporations plan and execute capital projects.

The above factors suggest that the playing field for the delivery of capital projects in China is demanding, and success will not come easily in spite of market opportunities and more favorable foreign direct investment policies. Below we provide an overview of some of the contributory factors and trends observed over the recent years. We focus on trends for projects executed by solely by multinational corporations, assuming that this will be the modus operandi for them in the short-term. We plan to address the practices, risks, and performance of projects by Chinese companies in a separate article.

China’s Cost and Schedule Advantage

IPA research has shown that China’s cost competitiveness gap with the West has been narrowing. The erosion of China’s capital cost advantage over other manufacturing locations has been the focal point of discussions on China investment. IPA data show an increase of about 40 percent in the average all-in labor wage rate between the 2010-2014 and 2015-2019 periods. Apart from rising labor costs, contributors to the overall cost increase include the reduction of government subsidies for domestically procured materials (rising materials costs), increasingly stringent environmental requirements, project requirements for investments in infrastructure, as well as exponentially increasing land costs.

However, China still offers a cost advantage overall and for the majority of cost categories, such as office costs (detailed design and project management), equipment, and field labor. The savings differ by category from 5 percent to about 30 percent.

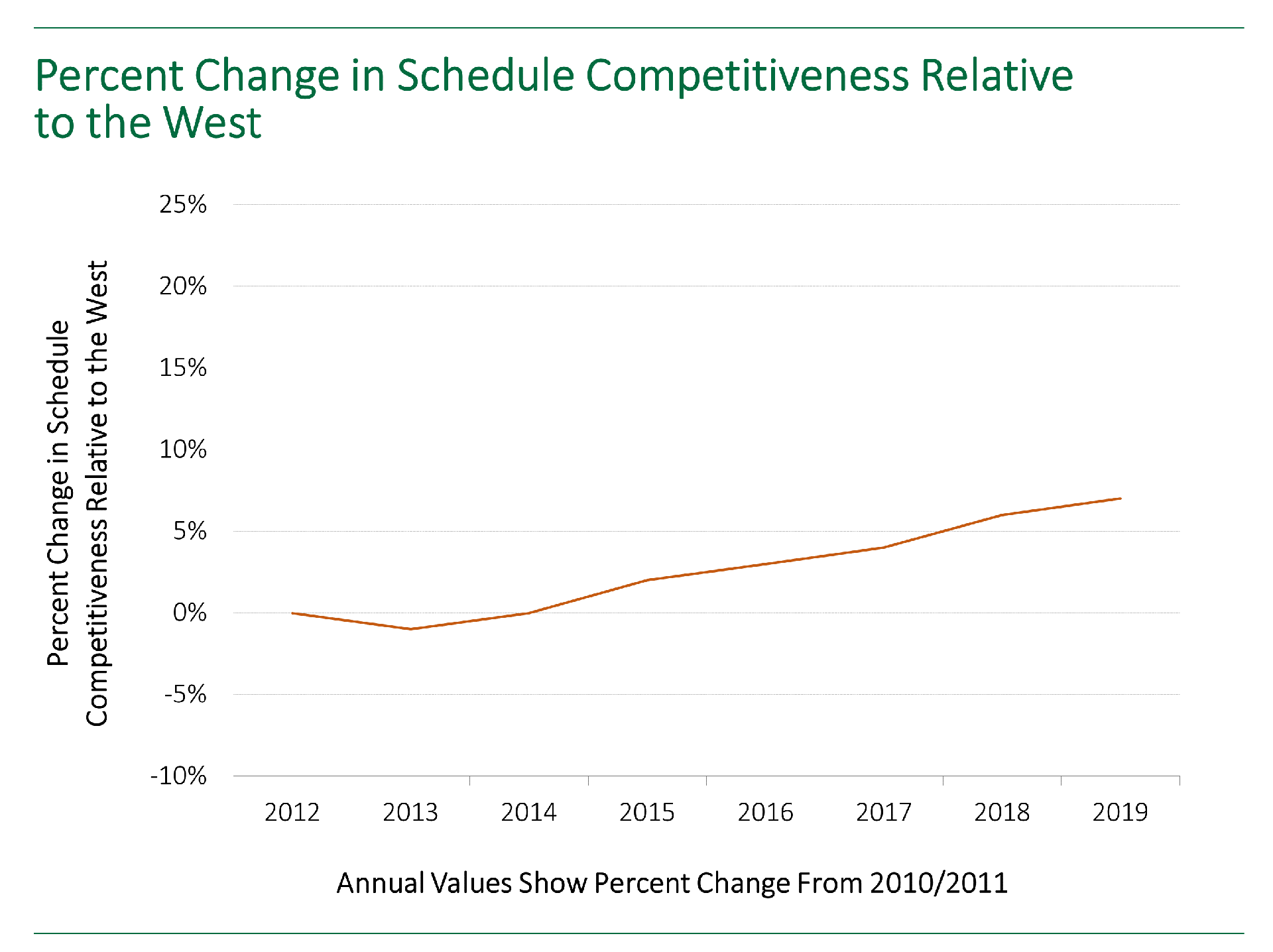

Construction schedules—from first foundations to mechanical completion—during the same period are trending faster. However, overall execution—from the start of detailed engineering to mechanical completion—has not changed significantly as shown in the figure, driven by a greater gap between engineering and construction, largely due to permitting requirements.

Shrinking cost competitiveness without any improvement in schedule performance imply that project economics will be more sensitive to cost growth and schedule delays. Therefore project risks will need to be mitigated as much as practicable.

Key Risks for Capital Projects in China

Key risks for projects in China based on recent projects that IPA has evaluated include:

COVID-19: The impact of the COVID-19 pandemic on the engineering and construction market in China is uncertain. Over the past two months, construction sites and manufacturing facilities shut down, sending shock waves not only across domestic projects, but also globally since major global projects procure from China. Although manufacturing facilities were gradually coming back to life at the time of this writing, the short- and long-term effect on the engineering and construction market will depend largely on factors such as a possible second outbreak wave and restricted movement of resources, as well as plans at a national or corporate level to defer planned investments due to capital constraints. Companies may also consider reducing reliance on Chinese manufacturing by establishing bases elsewhere in Asia.

Permitting and Regulatory Changes: Regulatory issues pertain to government approvals for different activities from land acquisition to environmental permitting and obtaining access to utilities. Sixty percent of the respondents in a recent survey conducted by IPA believe that the Chinese regulatory environment has become more unpredictable, and almost 90 percent stated that their companies had recently put projects on hold due to permitting issues.

Addressing this issue may include starting the project early, spending more time engaging local experts prior to sanction and communicating more frequently with authorities to stay ahead of potential changes. At the same time, project cost and schedule targets, as well as business case stress tests, should take into account this uncertainty in the form of scenario analyses.

In addition, China is becoming more environmentally conscious not only at the local government level, but also among the community. Multinational corporations investing in China should therefore expect (depending on location) to encounter issues with local communities that may object to investment in their vicinity. This is a significant shaping issue and multinational corporations need to address these risks as early as the start of pre-FEED.

Supply Chain Management: The capital project supply chain in China has come a long way since IPA’s first China study in 2005. The improvement is partly due to local owner project organizations pushing for better quality, often involving significant coaching from the owner side. For example, our most recent (2019) study shows that the percentage of projects in China experiencing issues with locally sourced equipment reduced from 40 percent in 2010 to about 15 percent in 2019.

Despite significant improvement, multinational corporations still need to rigorously manage procurement quality and schedule. For example, a key risk is the ability of Chinese vendors (without significant exposure to multinational corporations) to adequately manufacture to Western standards within the requested deadlines because they lack familiarity with these standards. Recently, an multinational corporation planning procurement from China modified some of its standards to match the equivalent GB code. The expectation was that it would reduce the burden on Chinese vendors and mitigate performance risks.

Undoubtedly, managing vendor and contractor performance is a global issue. China has not been immune to challenges such as changing demographics that result in a lack of experienced staff. Owners, therefore, must pay attention to practices such as pre-qualification and vendor/contractor selection, as well as strong project controls and expediting in execution, in order to take advantage of the lower costs, without compromising schedule or production.

Next Steps

China’s market size offers opportunities for multinational corporations with products that meet the Chinese government’s future product manufacturing mix plans. Stricter environmental regulations will also favor companies that have experience operating in similar regulatory environments.

Success, however, will not come easily. Moving forward, multinational corporations will need to plan projects rigorously in order to fully capture China’s competitive advantage, especially in the current COVID-19 environment. This is of paramount importance particularly for companies that are new to China.

In all cases, however, companies need to set realistic expectations of what the Chinese engineering and construction market can deliver. This requires market intelligence and data that support setting realistic cost and schedule targets.