In Offshore Wind Auctions, CAPEX Knowledge Pays Off Big Time

Offshore wind power, a key pillar of the energy transition, faces significant uncertainty in project capital cost development. The tremendous innovations seen in offshore wind (turbine sizes increasing, cost of manufacturing dropping, etc.) have allowed this sector to slash the cost of power generation. However, predicting the capital expenditures, or CAPEX, of projects in this sector provides some challenges, especially when it comes to offshore wind auctions.

Offshore wind auctions, the point at which an opportunity becomes a project, are conducted when bidders face excessive uncertainties related to project economics. In placing their bids, owners need to consider the viability of an offshore wind farm within a complex matrix of trade-offs, including CAPEX, project operations, clustering benefits, offtake agreements, project capacity factors, financing, and gaining market share and/or strategic value. What makes these trade-offs more difficult is that the maturity of the information is lacking at this point of commitment and the risk and uncertainty the project team is dealing with tends to be nontraditional (e.g., external or shaping).

These conditions lead to increased risks and a greater chance of the auction’s winning bid far exceeding the asset’s actual worth, a tendency known as the winner’s curse. Having a clear understanding of what drives a particular project’s realistic CAPEX at the time of auction—and what exact future efficiencies in specific scopes can be gained and how—is essential to avoiding this trap and is the focus of current IPA research.

Developing a Reliable Offshore Wind Auction Bid

Wind auctions often take place when projects have low maturity, which brings a high risk of cost overruns. In the absence of information, developers must bet on future efficiency gains and equipment negotiations, which may not materialize as planned. While some recent auctions have been structured with frameworks that are more conducive to strategic bidding, they can still lead to a business model in which the winning bid in an auction does not correspond with the project’s intrinsic value to the shareholders.

To develop an accurate bid, owners need to build their own estimates from the bottom up using various quotations such as wind turbine agreements and contractor quotations. Key factors such as uptime history, cost of financing, local content requirements, and pricing need to be considered. In addition, innovations that lead to improved CAPEX should be considered to develop bids that win.

Owners struggle to balance the fear of missing out with the need to create shareholder value with their projects, and we suspect there is a large cost to price differential with bids not reflecting actual estimate costs in recent auctions. It is important for owners to know in this environment where specific CAPEX efficiencies can be gained and in what way they may be achieved, so owners are not left holding the bag.

The Main Drivers of Offshore Wind CAPEX: What We Know So Far

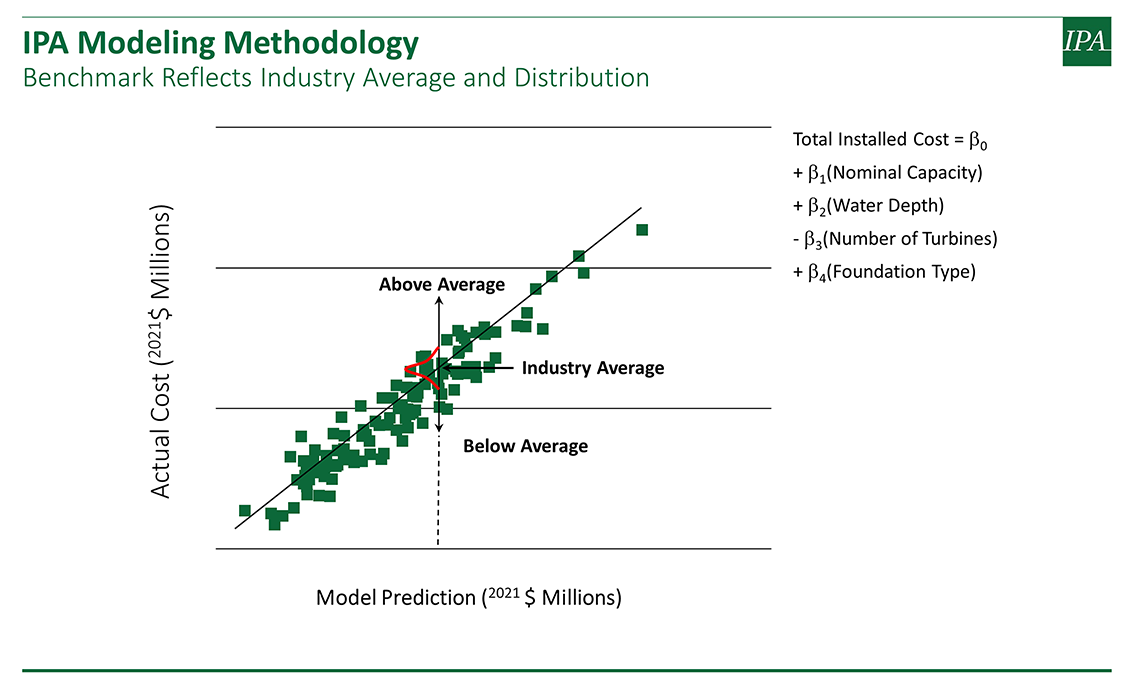

Considering this complex scenario, IPA has developed a number of benchmarking tools for the offshore wind industry that can help owner companies properly diagnose where they stand in regard to CAPEX, where project delivery might be improved, and where they can gain efficiencies post auction. One key model in our suite of offshore wind services looks at the drivers of total cost of an offshore wind project with the goal of helping owners to define the right bids and ensure they are picking the right projects.

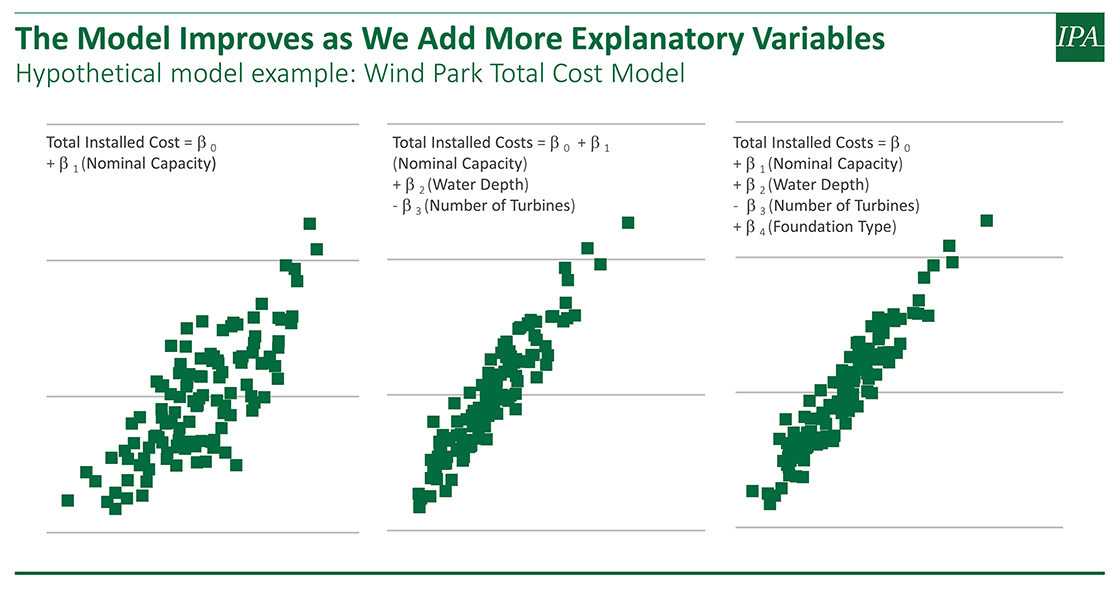

To determine the CAPEX drivers in offshore wind projects built to date, IPA uses multivariate regression models. These models allow us to explain more of the variance for a specific project with higher accuracy as we add each of the variables above. As shown in the sequence of graphs below, the model’s predicted cost becomes more closely aligned with the actual cost as additional factors are considered. Adding water depth and the number of turbines, for example, to the nominal capacity improves the accuracy greatly; adding foundation type to these three factors improves it even further.

Now that we have the model built and tested, we can give a total cost benchmark for projects with a specific feature set. IPA uses this methodology to give owners a quantitative measure of a project’s total cost relative to industry projects with similar characteristics.

The Evolving Offshore Wind Industry

As the offshore wind industry evolves, it faces numerous challenges. In addition to supply chain disruptions, this sector is now facing uncertainty in the execution phases (design and construction), as well as soaring logistics and materials cost escalation.

IPA research into the drivers of offshore wind power outcomes to date has not uncovered much variance around nominal capacity or location factors. However, most completed projects have been close to shore and in similar geographies. As projects go into deeper waters, further from shore, and with more challenging seabed and metocean conditions, we expect CAPEX variance to increase. Projects in deeper water require foundations that are more complex and more expensive, with higher installation costs.

Further complicating this scenario is recent inflation in key areas such as steel and logistics, tight supplier markets for turbines and HVDC cables, local content requirements, and increased demand for appropriate vessels. OEMs are distressed from inflationary pressures and logistic challenges. For example, wind turbine manufacturer Siemens Gamesa recently made changes to leadership after issuing a series of profit warnings, which signals a path to upward forces on turbine costs. Contracting and commercial models are also changing, with OEMs now less inclined to take on construction and subcontractor risk, leading to a greater need for proper contract and package interface planning by owners. And, as previously mentioned, the supply chain headwinds also seem to be accumulating.

IPA’s Role in the Path Forward

IPA’s sole focus over the last 30+ years has been to help our clients spend their capital better to maximize capital efficiency. Our work with wind industry clients is no different in this regard. Understanding CAPEX has become increasingly important for projects to meet the returns promised to the shareholders at the bid stage. To help improve wind sector capital efficiency, IPA continues to gain a better understanding of value drivers, cost levels, and risks that offshore wind project owners face during construction. As discussed, this uncertainty is especially true at the point of placing a bid, when other factors that affect a project’s viability are still nebulous. We therefore would like to gain a deeper look at the other inputs to levelized cost of energy (LCOE), such as fixed and variable operations and maintenance (O&M) costs, capital costs, wind resource assessments, and assumed utilization rates.

Benchmarking LCOE as a factor for decision making is our goal for the Offshore Wind Cost & Schedule Benchmarking study we are launching this year. Greater understanding of real, verified project data helps owners identify opportunities for capital cost optimization toward the reduction of the LCOE and to set competitive—yet realistic and achievable—targets.

Submit the form below to request more information on our work with offshore wind projects.