Restarting Projects Successfully After the COVID-19 Pandemic Lockdown

Planning for capital projects has picked up after the introduction and rollout of COVID-19 vaccines in 2021. During the past year, Independent Project Analysis (IPA) has regularly surveyed our clients—the global leaders in the energy, chemicals, consumer products, and other processing sectors—to quantify how they are navigating their businesses and capital projects through the pandemic. According to these IPA surveys, companies slowed, stopped, and canceled project work across their portfolios, reducing capital spend by 34 percent, on average, during 2020. Now in 2021, companies are in search of successful strategies for restarting projects as the world enters the vaccination and post lockdown stage of the pandemic.

Over the years, IPA has been at the forefront of investigating Best Practices for stopping and restarting capital projects. In 2020, we published research and provided special studies to help our clients manage the unprecedented market uncertainty and lockdowns occurring in the early stages of the COVID-19 pandemic. Now in 2021, we continue our mission to improve our clients’ capital effectiveness by conducting quantitative analyses of the myriad risks and different Best Practices for restarting capital projects after an unplanned stoppage.

While the market disruptions caused by the COVID-19 pandemic are unparalleled in recent history, unexpected and protracted project stoppages are not without precedent. In the wake of the 2008 Global Financial Crisis, IPA observed a number of projects that stopped and restarted, with an average stoppage period of 13 months. In recent years, natural disasters, including hurricanes making landfall along the U.S. Gulf Coast and large wildfires across North America and Australia, forced owners to stop projects in their tracks and map out plans to get them going again.

IPA has reviewed over 200 capital projects stopped due to a force majeure or major market event that later restarted and completed project work. These comparison projects range in size from $17 million to over $5 billion and were located in the United States, Europe, and Asia. The projects are representative of a diverse set of industrial sectors, including refining, chemicals, and mining. Both cost- and schedule driven-projects are represented, as are greenfield and brownfield projects.

Difficult Project Restart Decisions Lie Ahead

As more of the world population is vaccinated and transitions out of lockdown, business leaders face increasing pressure to deliver projects that strengthen their company’s market position and competitiveness. Capital managers and project sponsors must align on the value proposition for each project in the portfolio, balancing risks associated with the remaining execution against their forecast revenues, or other business justification for the project. Business has to manage cost-benefit risk by deciding which projects to cancel and which projects to restart. The next important decision after that is selecting the best restart strategy for each project to deliver their business value.

Owner companies should be aware of the different risk profiles when restarting their capital projects. IPA research shows that outcomes differ considerably depending on the project lifecycle phase in which the stoppage occurs. Projects stopped and restarted during the definition phase of the work process, before detailed engineering and construction, had similar outcomes to projects that never stopped and restarted. In contrast, projects stopped and restarted after the definition phase averaged about 5 percentage points more cost growth than uninterrupted projects. Moreover, IPA research has found that projects stopped and restarted during the construction phase average significantly more cost growth than projects stopped and restarted during detailed engineering. These typical outcomes impact project economics and should be considered during the restart decisions.

IPA research has found that projects with long deferrals have considerably more business risk, averaging lower net present value (NPV) than projects with shorter postponements. Projects with lengthy postponements are more likely to encounter changes in permitting and government regulations that disrupt execution plans, contributing to higher total costs and less predictable construction schedules. There is also risk of losing key owner and contractor team members, along with their valuable execution knowledge. In addition, owners should expect to re-negotiate contracts with material and labor suppliers after a long postponement.

Do Not Rush Project Restarts

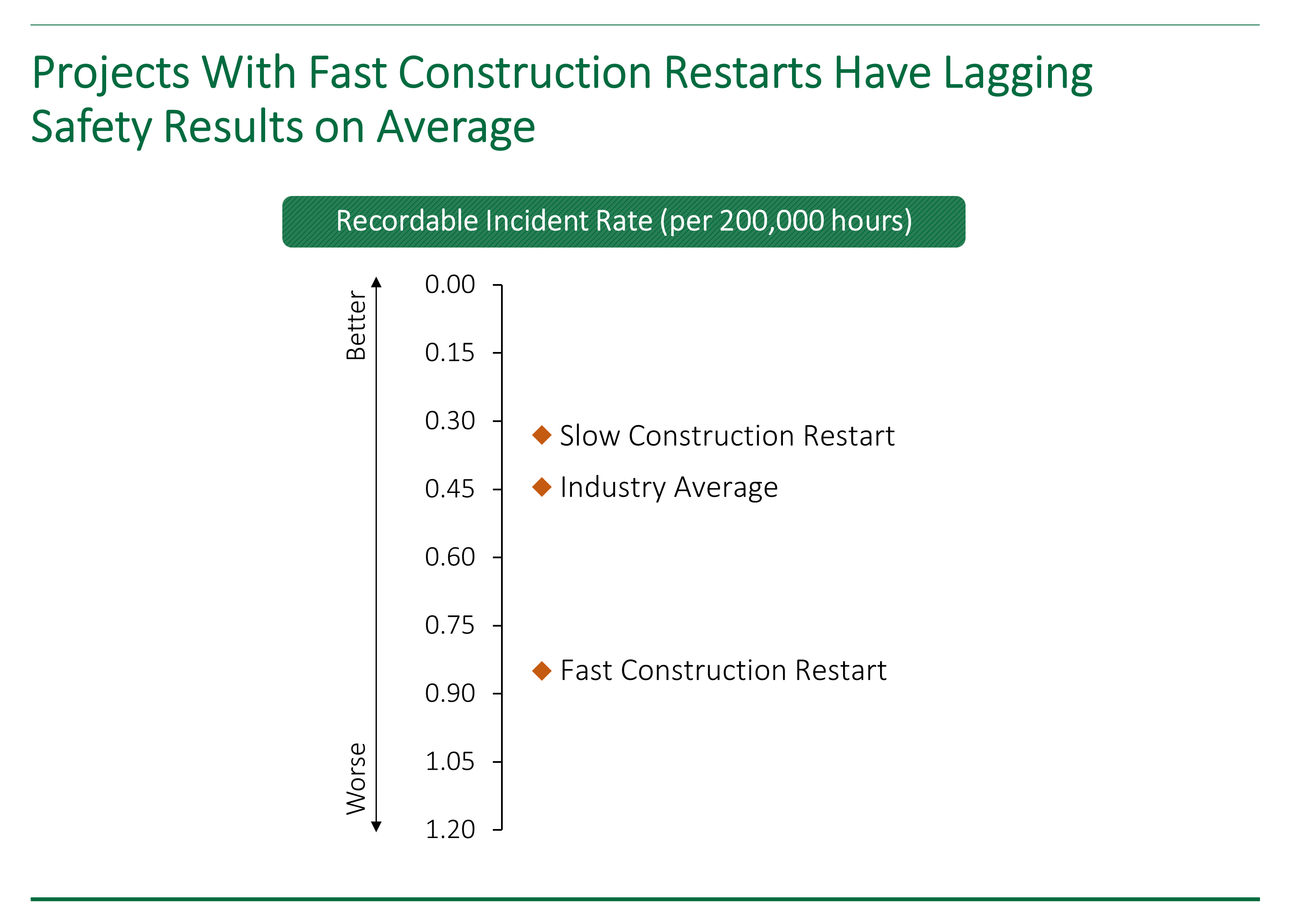

Business and project teams too often overestimate their ability to mobilize and coordinate resources when restarting projects, for example, by not hiring enough safety mangers to keep pace with aggressive field mobilizations during fast construction restarts (Figure 1). IPA research has found that best performers have strong QA/QC programs that support their transition from engineering to construction. The transition from construction to operations is another risk area for projects restarting after postponement. Owners should not overlook startup risks as final operability contributes greatly to a project’s NPV. Business and project teams should be aware of how even relatively short postponements can present challenges to smooth start ups.

IPA has the industry data and experience to help project leaders protect the value of their capital investments. Since the onset of the pandemic, we have worked with numerous site managers, business sponsors, and CEOs to develop risk mitigation and scenario planning strategies. We provide capital solutions that are specific to each client and their respective project portfolio(s) to help them succeed in the new economic landscape created by the COVID-19 pandemic. Contact us to learn more about the risks and Best Practices for restarting capital projects.