The Business Case Makes the Project!

There’s an old expression in project management: “Do the right project and do the project right!” The implication is clear—that it is common to do good projects with poor business cases and vice versa. It turns out after careful examination that this distinction between the right project and the right execution is mostly wrong. Our study demonstrates that if the business case that sets scope development in motion is a strong and compelling idea, the project that follows is very likely to be strong as well. Conversely, weak business cases routinely produce weak projects.

Within the community of companies that makes up IPA, there is very good agreement about what constitutes Best Practices in capital projects from the point at which we start scope selection right through turning the project over to operations. We understand that the product of FEL 2—the scope development phase—should be a centered cost estimate with a range around it, and a centered schedule with a range around that. At the end of FEL 2, the business decision to go forward or not on a final basis will be made. That is not Final Investment Decision (FID). FID will wait until we have finished FEED and all execution planning, which helps ensure that we actually get the planned work done (sometimes we do and sometimes we don’t).

When we move back from FEL 2, our consensus of what constitutes Best Practice falls apart. We have a basic agreement about what the activities should be. We know that we need to articulate the business need or the business opportunity. We should look for non-capital solutions and do a project only if required. If a capital project is required, a business case for that project needs to be developed. We need to identify a set of alternatives, we need to progressively narrow that list, and, finally, we select a single scope to optimize, bringing us to closure around FEL 2.

But if we agree on the basic activities, we don’t agree on who should do what, what the work process will be, and—most especially—on what constitutes a best practical level of development in the business case. We understand all too well that when the business case is weak, at the end of the project everyone will wish that we had not done it at all. Unfortunately, it isn’t really uncommon for us to go forward without a fully robust business case. So how can we know whether the business case is strong enough to generate a good result or whether the result will be a poor one? That is the role of the Project Viability Assessment (PVA).

The PVA is a project evaluation conducted just as the project is about to commission the scope development team to do its work. We developed the PVA after assessing the business case development in over 1,000 capital projects in the IPA databases. The projects ranged from about $40 million to just over $500 million. All are onshore and are distributed around the world. All types of projects are represented, from pure brownfield revamps to true greenfields. Commodity and specialty chemicals, refining, mining, pharma, and distribution projects are all well represented.

We examined the completeness of the business case development in four major areas with a number of questions within each:

- The business basics—objectives, priorities, key business risks

- The financial side—market windows, cost limits, competitor analysis

- Site and location issues—operations acceptance, site regulatory, and HSE

- Scope frame—product slate and capacities, technology, and OSBL and infrastructure

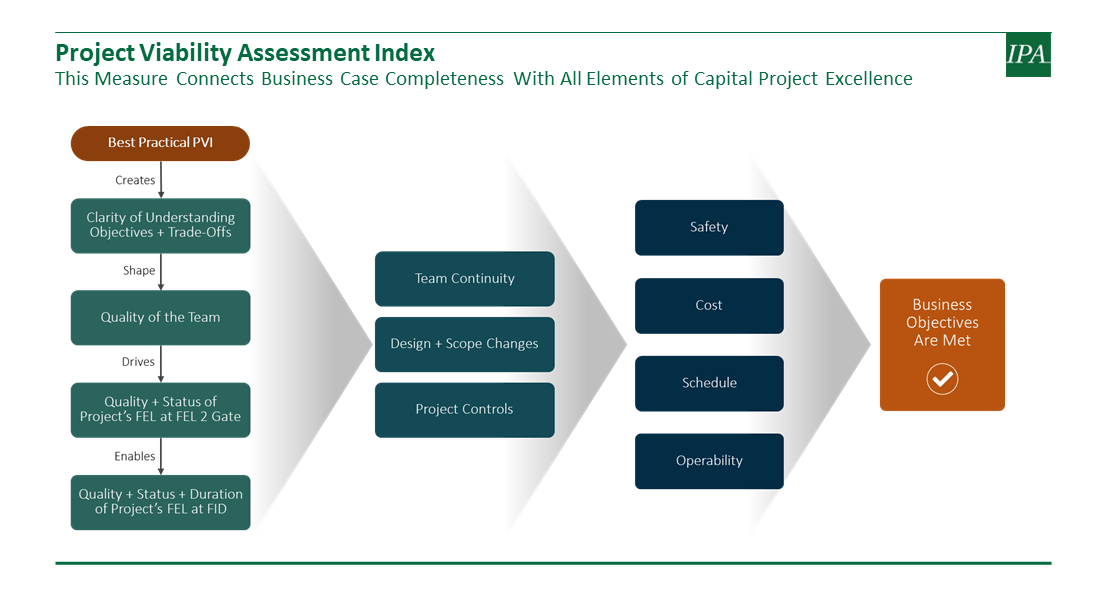

From these data, we developed a Project Viability Index (PVI) that functions for Gate 1 (the business-to-scoping gate) the way that the FEL Index works for Gate 2 and beyond. We then explored the relationships between the PVI and all elements of the project, as shown below.

What we found amazed us. The above chart shows 11 blocks that represent the elements of good projects and every single one of them is driven by the PVI—even team continuity, changes, and controls! And the strength of the relationships is remarkable. Even safety is predicted by a good business case—DART1 and recordable incidents fall significantly as the business case improves. Of course, it isn’t the business case that directly improves construction safety. But the business case drives good front-end loading and enables better controls. These practices in turn drive safety.

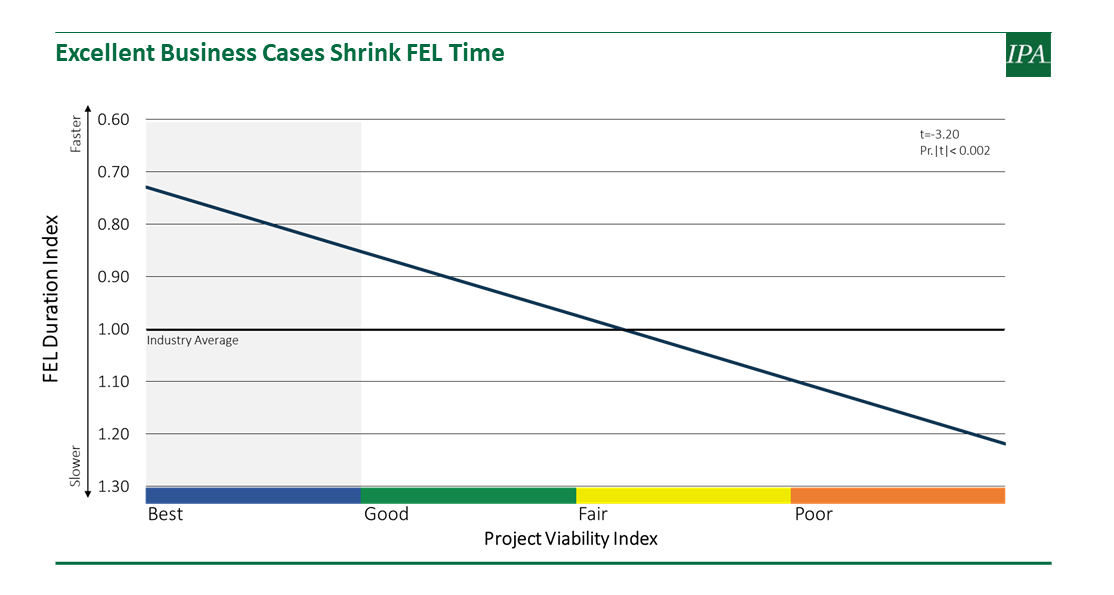

One of the complaints that business has about capital projects is that they take way too long on the front-end to bring to FID. It turns out that the best predictor (and driver) of FEL 2 and FEL 3 time is the Project Viability Index. As shown in the chart below, when the business case is fully defined, the time requirements to achieve excellent definition shrink by 30 percent from average. And as the PVI quality declines, the time requirements go up and up. There is a 50 percent swing in FEL time from low to high.

At the end of the day, cost, schedule, operability, and safety are all significantly better with a better PVI. And, of course, the reason we did the project in the first place—to meet business objectives—is routinely achieved with a good PVI.

Who benefits from a Project Viability Assessment?

- The scope development team is in a much better position to find the right scope quickly

- Governance of the capital project system is enhanced

- Project teams will find their work easier to do with fewer changes

- But the biggest beneficiary by far is the business sponsor of the project!

What is involved in doing a PVA?

The PVA entails a 2-hour interview with the business sponsor and others working on the project business case development with an IPA PVA analyst. Once the questions are answered and the documentation requested is provided, the PVA is ready within a calendar week.