In this case study, we provide a brief look at how a troubled project facing major overruns was able to minimize the damage in mid-execution through IPA’s Cost and Schedule Risk Analysis (CSRA).

The Problem

A Europe-based chemicals company faced a problem in the execution phase of a major capital project. The project had experienced significant cost growth and schedule slip due to unforeseen events and was looking to develop a new forecast to completion based on the events that began almost immediately after the project received full funding.

The project had some significant setbacks after it was authorized. In addition to facing COVID-19 restrictions, the use of liquidated damages and chosen contracting strategy (a mix of time & materials and reimbursable) were uncommon in the local market and had to be modified. In addition, the complexity of the project scope did not become apparent until after authorization, meaning the team was not properly prepared to execute it. Finally, serious problems with the prime project contractor after execution started led to construction being stopped. All of these issues made the final execution strategy much more complex than originally planned.

What IPA Did

IPA had the original project premises and plans from sanction, but new information was needed to derive an accurate forecast to completion based on where the project was in its life cycle and what events had occurred up to that point in time. In addition to holding discussions with the project team, IPA reviewed the project’s monthly progress reports to understand the quantities that remained to be installed as well as the key events that had contributed to the changes to the project’s cost and schedule forecasts.

The monthly reports provided IPA with a lot of information, including progress made by discipline and craft, engineering progress made based on deliverables, and construction progress made based on quantities installed. Using this updated information, IPA was able to develop the project’s most likely cost and completion date based on what had occurred on the project to that date and what remained to be completed.

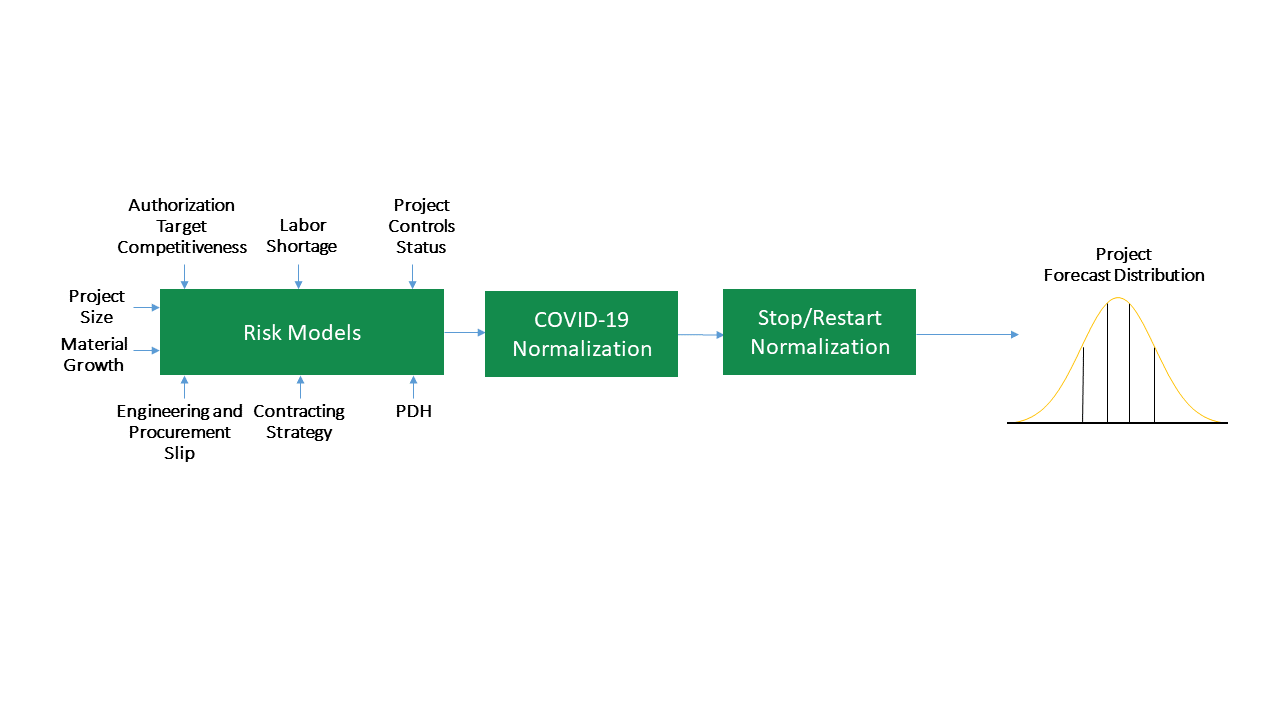

The key to IPA’s updated forecasts was taking into consideration all risk factors the project was facing—and how those risk factors interact. Typical Monte Carlo risk simulations only look at a project’s risks in isolation—they do not predict outcomes well because they underestimate the compounding effect these risks have on each other. For example, one of the challenges in getting a Monte Carlo schedule analysis to work is estimating correlations between activity durations in an effective fashion. Similarly, Monte Carlo-based methods for cost contingency setting fail because, although they focus on individual cost element distributions, cost estimates overrun because not all scope items are defined, not because the distributions around the individual elements are incorrect. Most industry projects use fabricated distributions, which are not based on historically observed and unbiased distributions of outcomes. In addition, these analyses assume orthogonality of the distributions, which denies the reality of projects in which most things are intimately connected.

How It Turned Out

IPA’s analysis showed that the team’s updated forecast to completion was still on the optimistic side and the likely cost and schedule at completion were higher than they anticipated. The updated cost and schedule forecasts provided the insights needed for the project team to return to the investment committee for additional funding. Although the project was too far into execution to avoid cost and schedule overruns, IPA’s updated forecast and recommendations allowed the team to target a more realistic final cost and schedule and complete the remaining execution phase as efficiently as possible.