Setting Up CCUS Projects for Success: Overcoming Front-End Development Barriers

At a recent industry event in Washington D.C., owner company representatives, technology providers, and policymakers expressed confidence in the potential of Carbon Capture, Use, and Storage (CCUS) project investments to help achieve global carbon reduction goals. In fact, many view CCUS projects as key to reducing the emissions from the hard-to-abate sectors, such as cement, steel, and energy. CCUS is also being embraced across capital-intensive industrial sectors as a critical means of carbon removal by capturing CO2 from the atmosphere and injecting it underground as a negative emissions sink.

At the same time, several governments have announced a commitment to support CCUS projects, either via direct cost sharing, subsidies, or tax credits like 45Q in the United States, signaling an approaching wave of global commercial-scale projects. In fact, several governments are looking to CCUS investments to help meet their Paris Agreement commitments. However, there is still a long way to go. According to Global CCS Institute[1] estimates, more than 2,000 large-scale CCUS projects are needed in the next 20 years to meet climate goals, but only about 1 percent of that, or about 21 projects, are in operation around the world today. Scaling up from 21 to thousands of projects will require a close assessment of the decisions and practices of past developments and the application of lessons learned.

Independent Project Analysis, Inc. (IPA) has completed project risk evaluations, including cost and schedule benchmarking reviews, on half of the large-scale CCUS projects currently in operation globally. We continue to engage with many CCUS projects, including some of the world’s largest CCUS endeavors, in different planning stages, ranging from early development to commissioning and start-up. All of these CCUS projects have similar complexities, but what stands out about the projects IPA has evaluated are their vastly different outcomes. The carbon capture scope cost in these projects ranges from quite competitive (cost outcomes consistent with industry norms) to significantly higher than average (cost up to 35 percent higher than industry norms). The schedule outcomes are not any better, with carbon capture scope execution being up to 40 percent slower than industry average. To help CCUS become a viable solution for climate change, it is important for commercial-scale projects to have competitive outcomes. Therefore, it is critical that we, as an industry, learn from previous projects and improve the performance of those in development to prevent CCUS projects from suffering a fate similar to nuclear projects. IPA worries that if owners and their project organizations do not leverage the known Best Practices for shaping these CCUS projects during early definition, the industry will have difficultly demonstrating the concept of large-scale CCUS as a viable business.

To help the industry successfully deliver CCUS projects, we plan to go over the different project development elements in a series of articles. Based on learnings from past CCUS evaluations and Best Practices from projects with similar complexity, this series will introduce the key factors that drive success, covering the need for clear business objectives, Best Practices for project shaping elements, and learnings from similar technology scale-up challenges. The first article of this series will discuss why these projects are complex and, importantly, highlight the role of having clear business objectives to steer their development and execution.

Why Are CCUS Projects Complex?

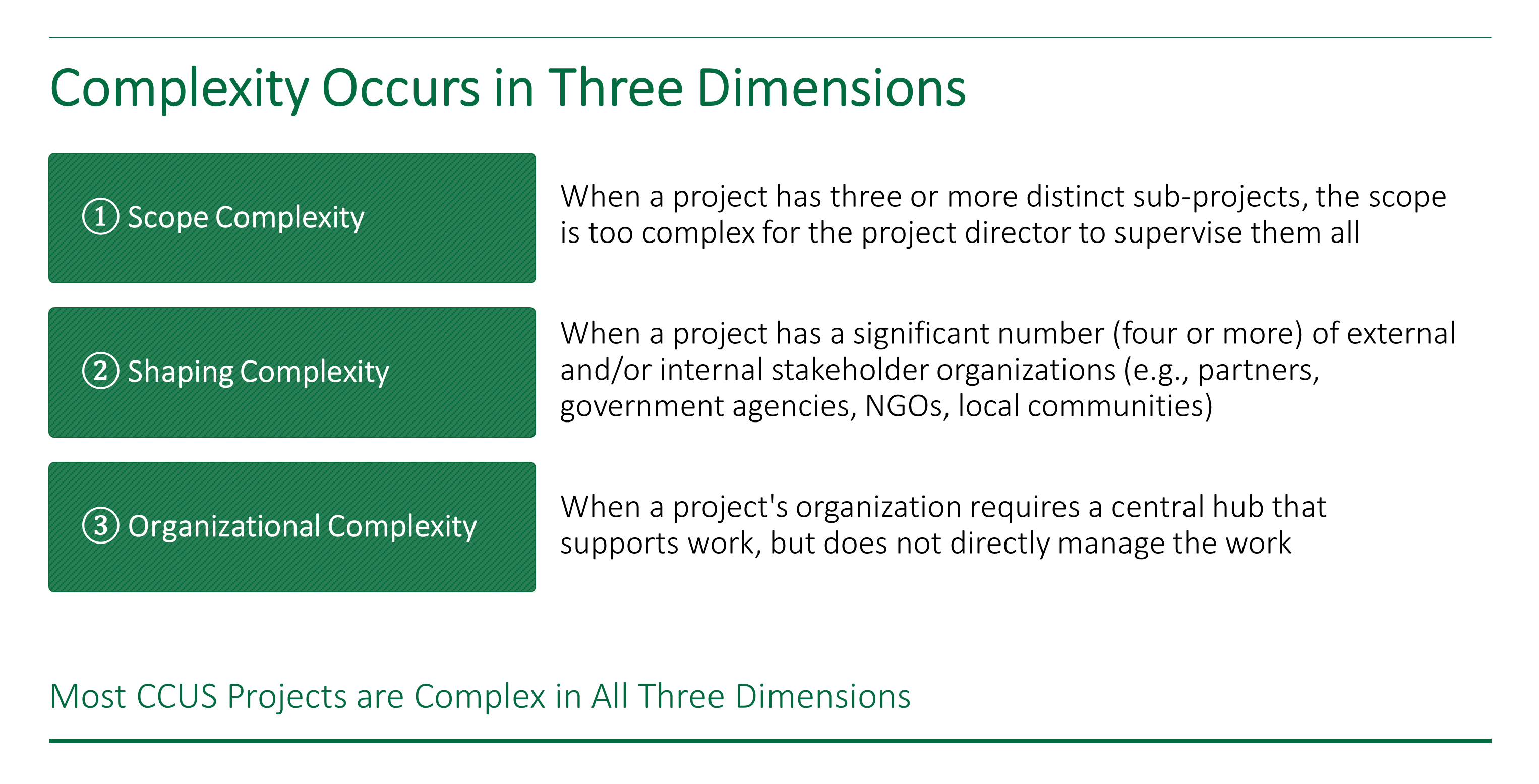

However, before we discuss the importance of having clear business objectives and reviewing their collective effect on project outcomes, it is important to understand why CCUS projects are complex as this is key to their planning and development. IPA measures the complexity of projects with respect to their size, cost, process steps, stakeholder involvement, design, and engineering and recognizes the following three dimensions of complexity related to CCUS projects:

Scope complexity—In our evaluation of CCUS projects, we observe that, many times, the CCUS value chain is broken up into distinct sub-projects such as carbon capture, compression, transportation, and storage. Although the technology used, particularly for carbon capture, has been tested in other situations, carbon capture technologies must be scaled up considerably for large-scale application. Reservoir complexity is another component that is poorly understood. Technical complexity, multiple interfaces, and challenges in scope development are to be expected.

Shaping complexity—Opportunity shaping issues are common in CCUS projects given that the CAPEX for midsized to large CCUS projects can range from US$200 million to over US$1 billion. Because a relatively low rate of return is expected, these projects often rely on either government incentives or a robust carbon pricing mechanism in the region to prove their financial feasibility. The involvement of additional stakeholders, including government entities, adds to the shaping complexity during the front-end.

Organizational complexity—CCUS projects are not typically the core business for the organizations involved with them, meaning multiple organizations usually must come together to create a viable working business for CCUS projects. As such, institutional knowledge and functional competence for executing large capital projects are often missing. The sponsorship[2] for such opportunities is also often weak, which naturally creates an element of organizational complexity and interfaces.

Taken together, these factors suggest CCUS projects behave more like megaprojects and are similarly complex.

Clarity of Business Objectives

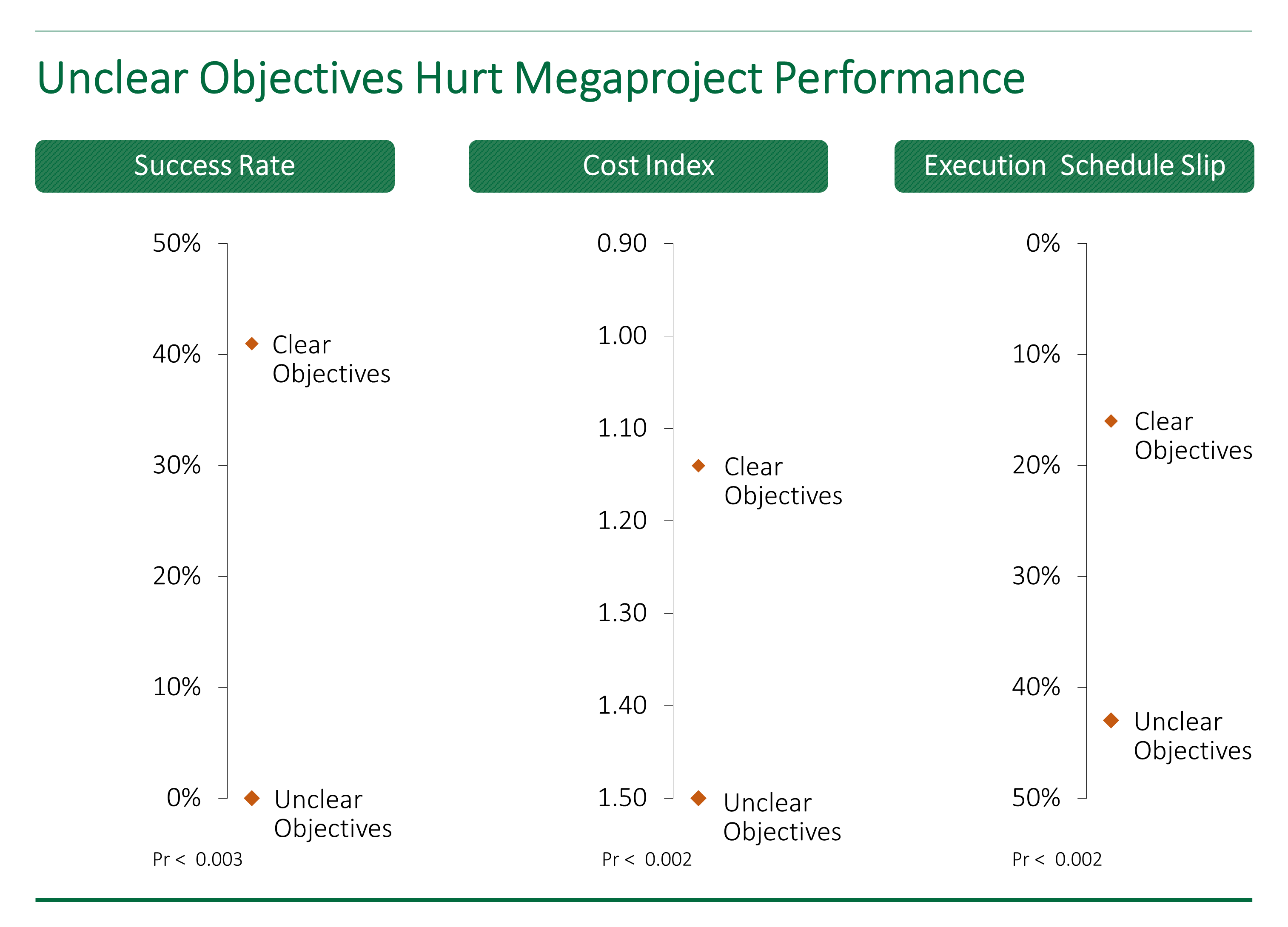

As IPA Founder and President Edward W. Merrow explains in his book, Industrial Megaprojects,[3] that megaproject success requires crystal clear business objectives from all sponsors (as seen in the figure below).

Without clear business objectives, projects cannot have clear and coherent project objectives. Project teams need to know what businesses are trying to accomplish and the attributes that will affect business outcomes, including the trade-offs (cost, schedule, and operability). These need to be documented and communicated widely.

When business objectives or trade-offs are poorly articulated or have a weak rationale, projects suffer. The project sponsor cannot build a collaborative and functional team to deal with the complexity of such large projects. IPA’s Business and Engineering Alignment Meeting (BEAM) tool helps resolve these issues and make business objectives consistent internally.

Are CCUS Projects Set Up to Succeed?

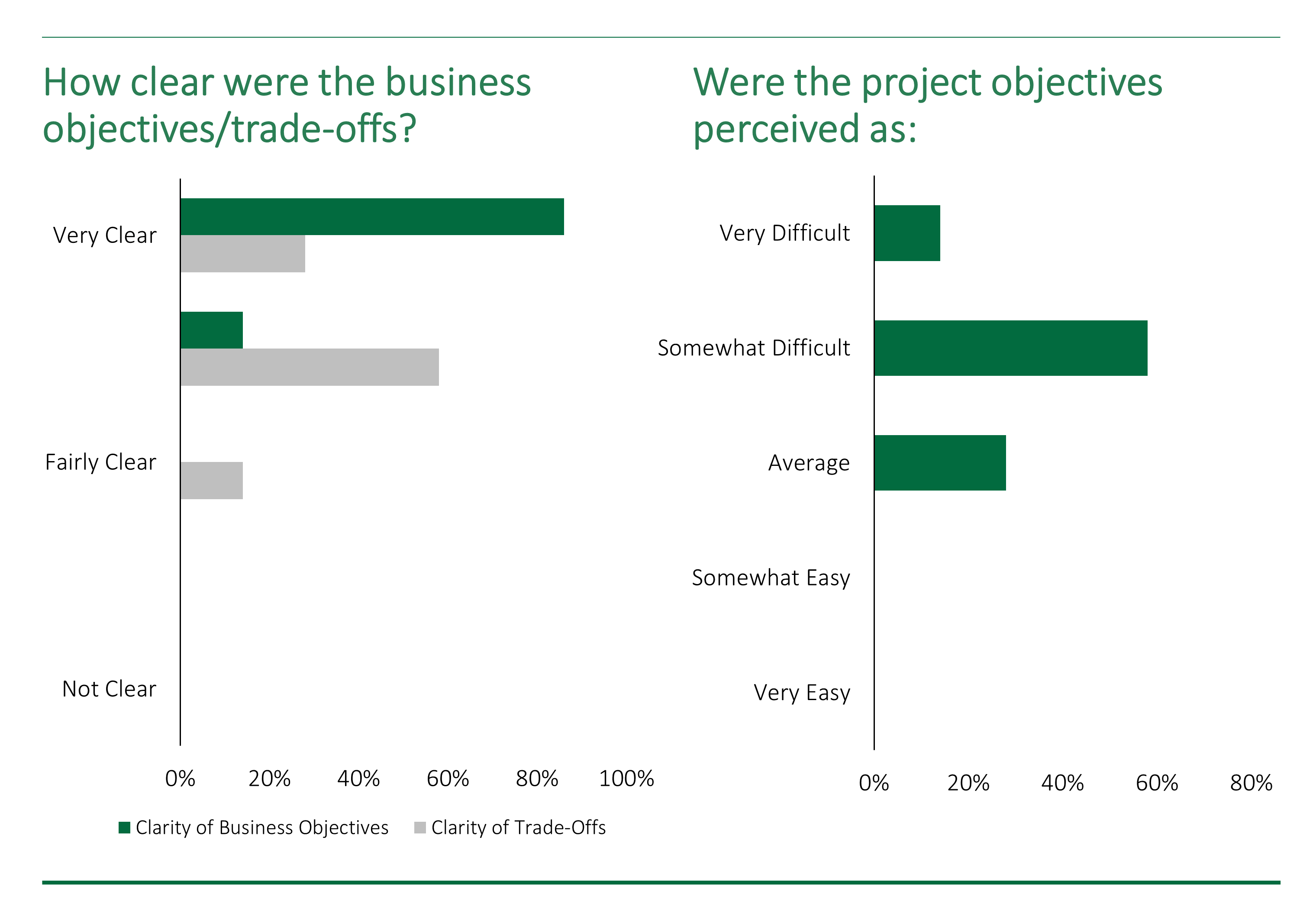

When we analyze the business objectives of CCUS projects in IPA’s database, interesting trends emerge. During our evaluations, we interviewed the project directors and asked them to rate the clarity of the business objectives and trade-offs for their projects. As seen below, most project directors have a clear understanding of the business objectives, which is good news. However, they struggle with and are less clear about the trade-offs among cost, schedule, and operability for that project. This is also reflected in the higher difficulty rating for meeting their project objectives.

As one project director put it during an IPA interview, “My bosses want to keep the cost low on this, and we are cost driven. However, we need high reliability and uptime in order to ensure we achieve the transportation and storage we promised, and we really need to get this project approved quickly before the next election at the end of the year as there is a possibility that the support for this initiative changes and disappears.” As expected, that project did not have good outcomes.

Clear business objectives are imperative for projects seeking to demonstrate new technology because the business goals may differ from a standard net present value (NPV)-driven project. In our database of capital projects, we have a subset of over 1,500 projects that deployed innovative technologies. The completed CCUS projects in operation today had outcomes similar to those seen in those innovative projects and can be characterized as demonstration projects. However, a demonstration project does not need to cost much more than a commercial project. The purpose is to get valuable data, but not lose money doing the project either. However, for demonstration projects, in addition to the cost, schedule, and operability performance measurement, sponsors should also define and measure three other areas of success:

- Application success—Proving the demonstrated technology works well in the local setting, which is important for all CCUS demonstration projects, particularly because they often intend to attract future potential projects

- Diffusion success—Unless the objective is to meet some high-level national policy goal, the demonstration project should help diffuse the technology into general use for the larger market to adopt

- Information success—The goal should be to reduce uncertainties to the point at which the lack of information does not prevent adoption decisions

When looked at as demonstration projects, few of the completed CCUS projects IPA evaluated were successful based on the measures above and they also failed to set up the pipeline of projects to succeed. In most cases, the demonstration worked well at the site (application success); however, the uncertainty around most elements could not be reduced (information success).

So far, the project scopes are not standardized, which would help bring the costs down (diffusion success). For CCUS investments, the supply chain is still evolving, with vendors and contractors lacking the expertise to deliver the scale and efficiency required. Local regulatory bodies have to react to the need for new regulations for subsurface storage and cross-country CO2 transport and for new mechanisms to incentivize carbon capture. These external factors increase the uncertainty of developing CCUS in most regions around the world, and the major hurdle for wide diffusion of the concept remains CCUS’s cost disadvantage over alternatives. This may be solved partially with a sufficient CO2 price or by developing some break-through innovative technology.

Overall, CCUS has not become run-of-the-mill and has not been set up yet to be a top mechanism to reduce CO2 emissions, which raises a question: If the business objectives of these projects were to demonstrate success, what were the particular gaps in their project shaping that fell short?

Conclusions

CCUS projects are difficult to execute given their objectives and trade-offs. Add to that the demonstration complexity, and more factors must be considered than the cost, schedule, and operability. Such projects require a strong sponsor with a clear idea of the business objectives, project objectives, and measures of success and these need to be communicated early and widely. Further, the industry needs to widely share and adopt Best Practices to kick start the next slate of CCUS projects globally. The good news is that repeatable capital project performance success is possible when sponsors, in addition to following opportunity shaping practices and establishing clear business objectives, gather sufficient Basic Data, follow a stage-gated governance process, and staff cross-functional project teams. More than three decades of IPA capital project evaluations and research using real project data have proven that quantifiable performance outcome improvements for complex projects like CCUS, including cost, schedule, and operational performance results, are achievable.

The next article in this series dives deeper into the elements of project shaping for CCUS projects—stakeholder management, project financing, and getting the Basic Data right. IPA continues to engage with CCUS projects in development to set them up for success with Best Practices and lessons learned. To learn more about how IPA can improve the predictability and competitiveness of your company’s CCUS project, please contact us by completing the form below.

[1] Global CCS Institute, Global Status of CCS 2019 – Targeting Climate Change, PDF, globalcssinstitute.com, 2019.

[2] An active investor in the project seeking to develop and benefit from a megaproject. The lead sponsor is responsible for pulling the stakeholders together.

[3] Edward W. Merrow, Industrial Megaprojects: Concepts, Strategies, and Practices for Success, Hoboken: John Wiley & Sons, Inc. April 2001.