Transitioning to New Energy: An IPA Energy Company Survey

Achieving net-zero emissions will require several significant actions, many of which involve redefining capital project portfolios that are shaped to meet climate objectives. These new era portfolios include opportunities that range from renewables to carbon capture and storage (CCUS). Challenges abound and are diverse: needed to achieve these goals are advances in technology to make projects viable, robust supply chains, expansive policy support, and people skills, to name a few. Given these challenges, we need to better understand where the energy industry is with regard to portfolio strategies and gated processes. IPA’s research shows these are critical components to project success and, therefore, if we can identify areas of improvement, the industry is more likely to achieve its net-zero emissions goals.

To understand the extent to which companies are changing their portfolios as they move toward a more sustainable future and to understand the perceived areas of difficulty for developing renewable projects, IPA recently surveyed a number of our energy clients.

Results From Our Survey of Energy Clients

Fifteen energy companies—including majors, national companies, and independents—responded to our new energy survey. Survey topics included portfolio strategies for new energy projects, external and internal barriers to project success, and governance for early decision making.

Portfolio Strategy

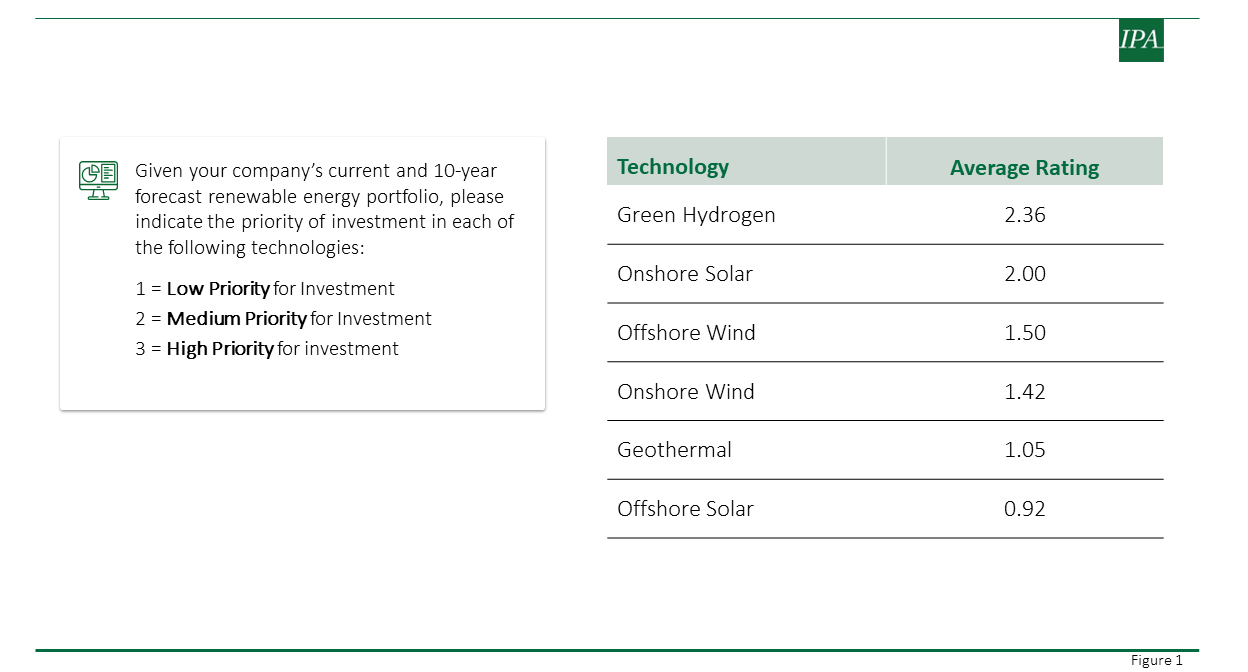

Most of the responding companies (80 percent) are involved in renewable energy implementation at some level. On average, the energy industry ranked developing renewable energy as a new business area as very important to the future. (See Figure 1.)

External and Internal Barriers

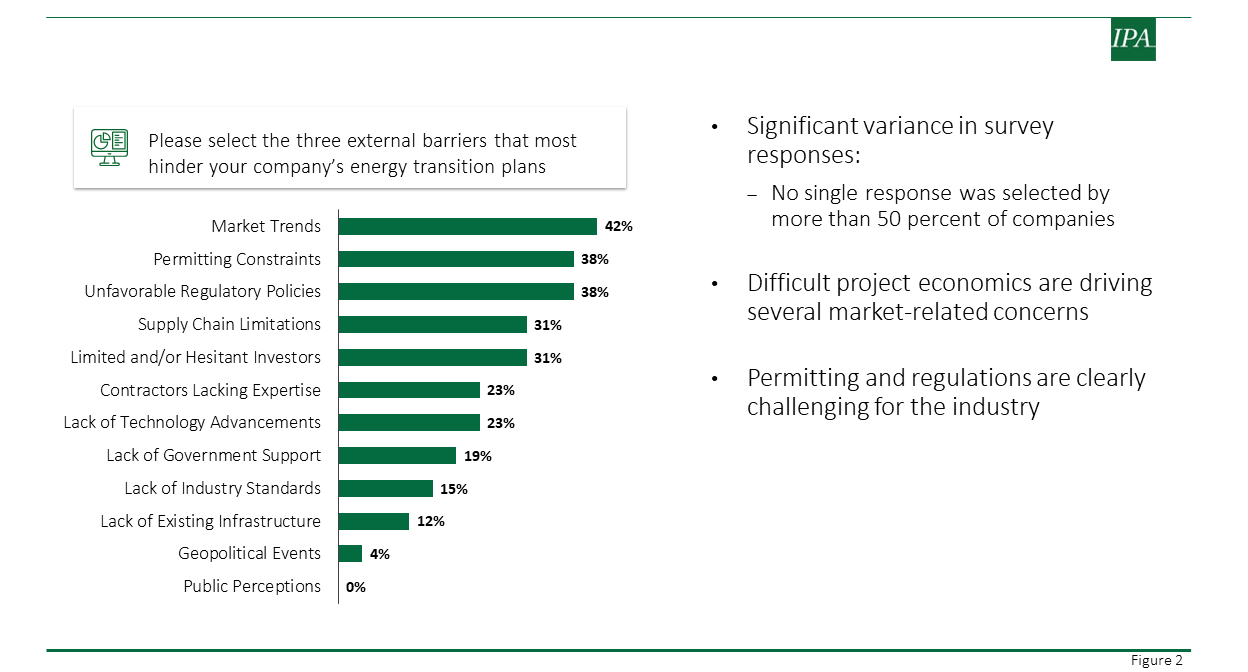

Survey respondents identified many external barriers to company energy transition plans, with a few standing out. These barriers include market trends (e.g., difficult project economics), permitting constraints and unfavorable regulatory policies, and supply chain limitations, as well as lack of contractor expertise, technology advancements, government support, and existing infrastructure. It is also worth noting that no single barrier was identified by more than 42 percent of the respondents. (See Figure 2.)

Companies identified supply change limitations as a major risk to renewable energy projects, with the heated market, lack of growth among suppliers, lack of supply chain maturation, future climate change risks, supply chain consolidation, current environmental risks, and lack of technology advancements all being rated as moderately significant to very significant risks.

Permitting also ranked high as a risk. Permitting is in a dynamic state as regulatory environments around the world are often unclear and constantly evolving, leading to unpredictable environmental approvals. This contributes significantly to the challenges that renewable energy projects must overcome by increasing their shaping complexity.

Governance Processes and Early Commitment

Marginal economics are clearly a major hurdle for renewable energy projects. The less than stellar economics and the barriers expressed in the survey suggest the importance of establishing a clear and disciplined stage-gated process that takes into account the business drivers of renewable investment and the many shaping issues that need to be addressed by the project sponsors. In addition, these projects have a need for Basic Data while at the same time, in many cases, they are forced to commit to the investment at a very early stage of project development (early commitment).

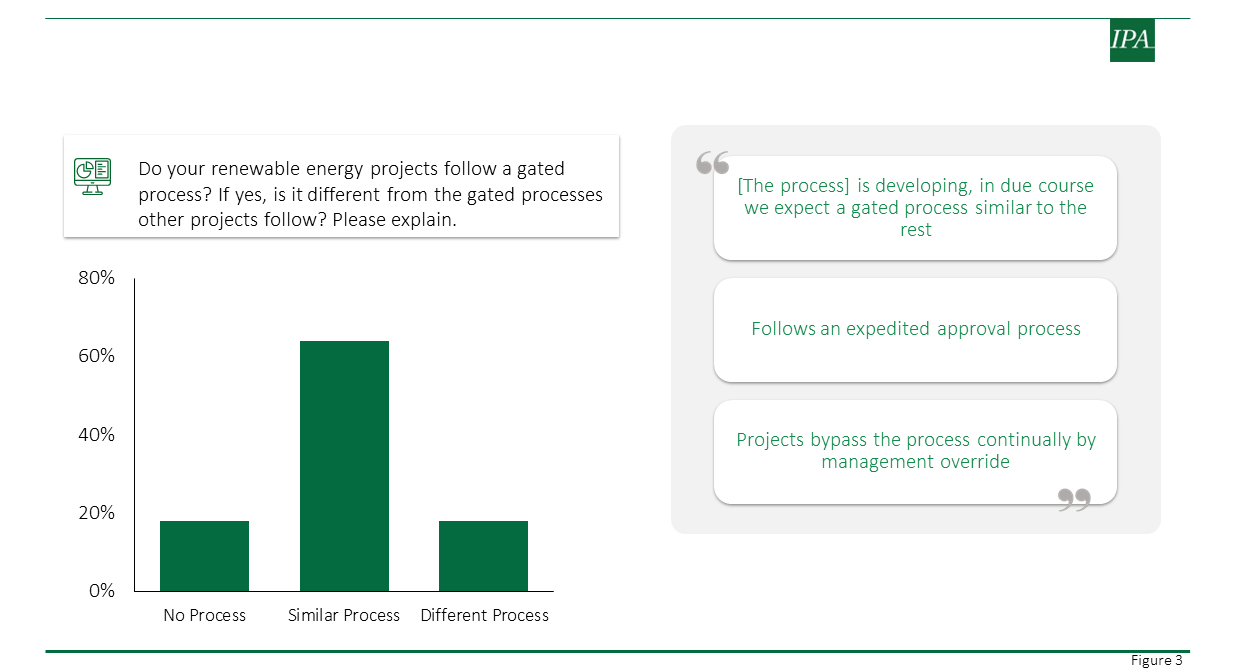

To understand what gated processes companies are employing on renewable energy projects, we asked the companies surveyed whether their renewable energy projects follow a gated process—and if they do, is it the same process that other projects follow? As shown in Figure 3, the majority of energy companies (60 percent) indicated that renewable energy projects do follow a similar process. However, these similar processes are sometimes expedited or in development, and in some cases, they are simply bypassed by management. The other 40 percent either do not follow a process at all or follow some different kind of process.

The Path Forward

IPA is actively helping our clients with this challenge and will continue to evolve our product offerings to address the increasingly complex project landscape. For additional information on how the gated process should be designed for early commitment projects, such as offshore wind and other renewable energy projects, see Pam Wertz’s article entitled Mitigating Risks of Early Commitment in New Energy Projects.